It can be tough to get around in Seattle and on the Eastside. As we add hundreds of people per week to our expanding city, and even more to the whole area, the problem is not going to go away anytime soon. More-flexible work schedules and people working from home will certainly help, but in the coming years, as Link light rail expands, the value of properties around those light rail stops were expected to go up. But now there is a study that substantiates that!

Category Archives: About Seattle

The Future of Puget Sound Area Traffic

Sound Transit has put forth an ambitious plan, called the Sound Transit 3 Plan, to extend Light Rail service throughout the Puget Sound area. The plan is currently receiving public feedback from a number of neighborhood meetings being held throughout the different neighborhoods that will be affected. The finalized plan may be on the ballot in November. All residents (not just homeowners – renters too!) need to be aware of the expansion plan, the timeline, and the bottom line. I encourage you to go to one of the live meetings if you are able to do so. Continue reading

Seattle Housing Market Update – Seattle Sets New Record For Median Sales Price In February!

SEATTLE HOUSING MARKET UPDATE

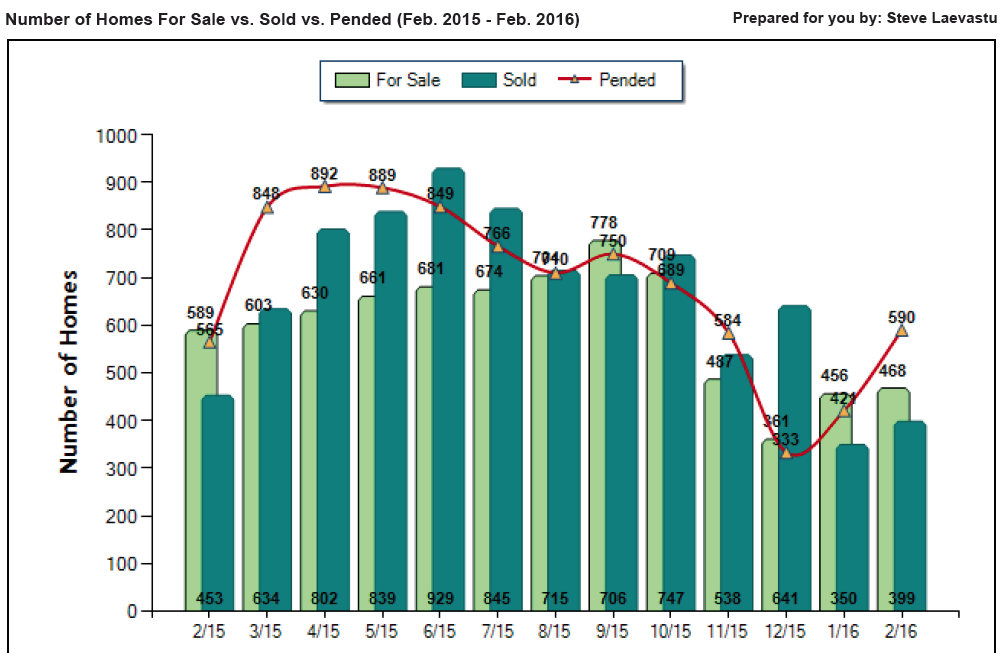

February 2016 was another RECORD SETTING MONTH FOR SEATTLE REAL ESTATE!!!

The median price of a Seattle home is now $625,000. This is a new record.

The old record was set back in January 2016 at $585,000.

The median price of a Seattle home is up 27% vs February 2015.

There were 590 pending sales in February, which is up 5% from twelve months ago when 565 pending sales were reported.

SO WHAT HAPPENED TO SEATTLE REAL ESTATE IN February?

In February there were 468 ACTIVE listings in the Seattle real estate market.

In February 590 homes went PENDING.

Which means that 1 out of every 0.8 homes on the market went pending in February.

This 0.8 ratio implies a 0.8 month supply of inventory.

The 0.8 ratio is a strong SELLER’S MARKET INDICATOR.

THE PAST 14 MONTHS HAVE SEEN THE BEST SELLER RATIOS EVER FOR SEATTLE ABSORPTON RATE.

Any ratio under 3.0 is a seller’s market indicator.

Any ratio between 3.0 and 6.0 is a neutral market indicator.

Any ratio over 6.0 is a buyer’s market indicator.

The story remains LACK OF INVENTORY.

EPIC RECORD SETTING LOW INVENTORY!!!

In February there were 468 ACTIVE listings in Seattle.

The 468 ACTIVE LISTINGS IS THE THIRD LOWEST NUMBER EVER RECORDED.

The record low was set two months ago (December 2015) with 361 ACTIVE listings.

The second lowest was January 2016 with 456 ACTIVE listings.

The 468 ACTIVE listings is 69% under our 10 year average for February inventory.

Another way of looking at it is that we are only at 31% of our average inventory for this time of year.

The February ten year moving average for inventory is 1,469 ACTIVE listings.

Also if we compare February 2016 to February 2015 we will note that even though inventory was low in February 2015 (589) it was even lower in February 2016 (468). Inventory is down 21% vs 2015.

In the month of February the AVERAGE list price vs sales price for Seattle was 103%.

So the average home sold for 3% over the asking price.

This is the 13th month in a row that the AVERAGE list price vs AVERAGE sales price has been over 100%

The AVERAGE days on market for a Seattle home was 26 days before they accepted an offer.

And real estate is always LOCALIZED. What I mean is that CERTAIN areas are moving better than other areas. Let’s take a look at list price vs sales prices for some different neighborhoods in Seattle for the month of February

- View Ridge and Hawthorne Hills 111%

- Ravenna 110%

- Laurelhurst 109%

- Bryant 107%

- Seward Park 107%

- Green Lake 106%

- Ballard 106%

- Madrona 104%

- Queen Anne 103%

- Wedgwood 103%

- Wallingford 103%

- Magnolia 102%

- Maple Leaf 101%

- Capitol Hill 101%

- West Seattle 101%

- Lake City zero sales in February 2016

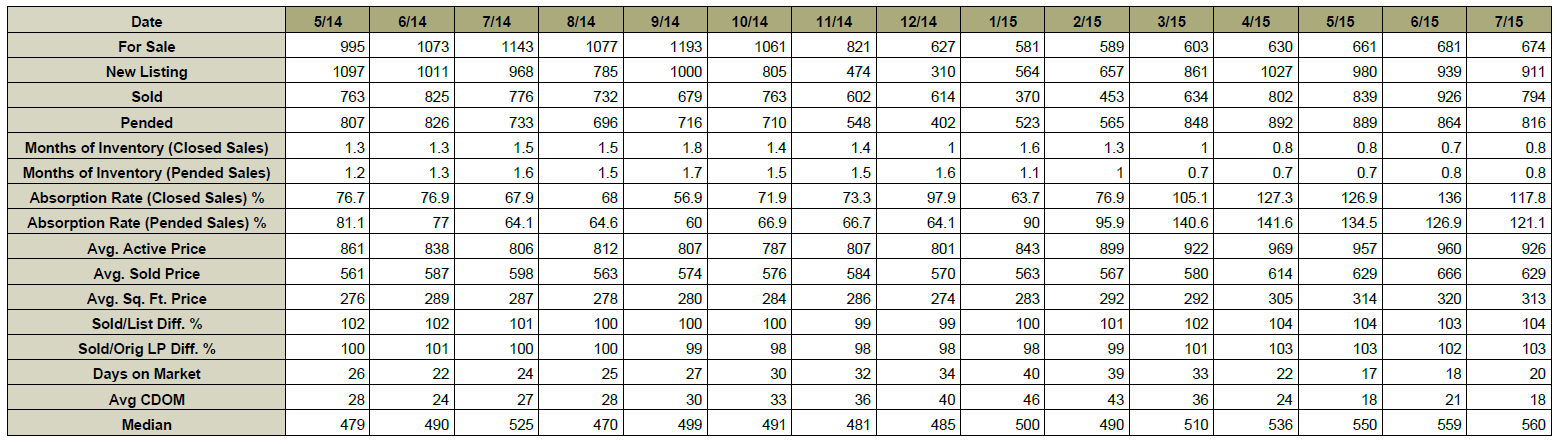

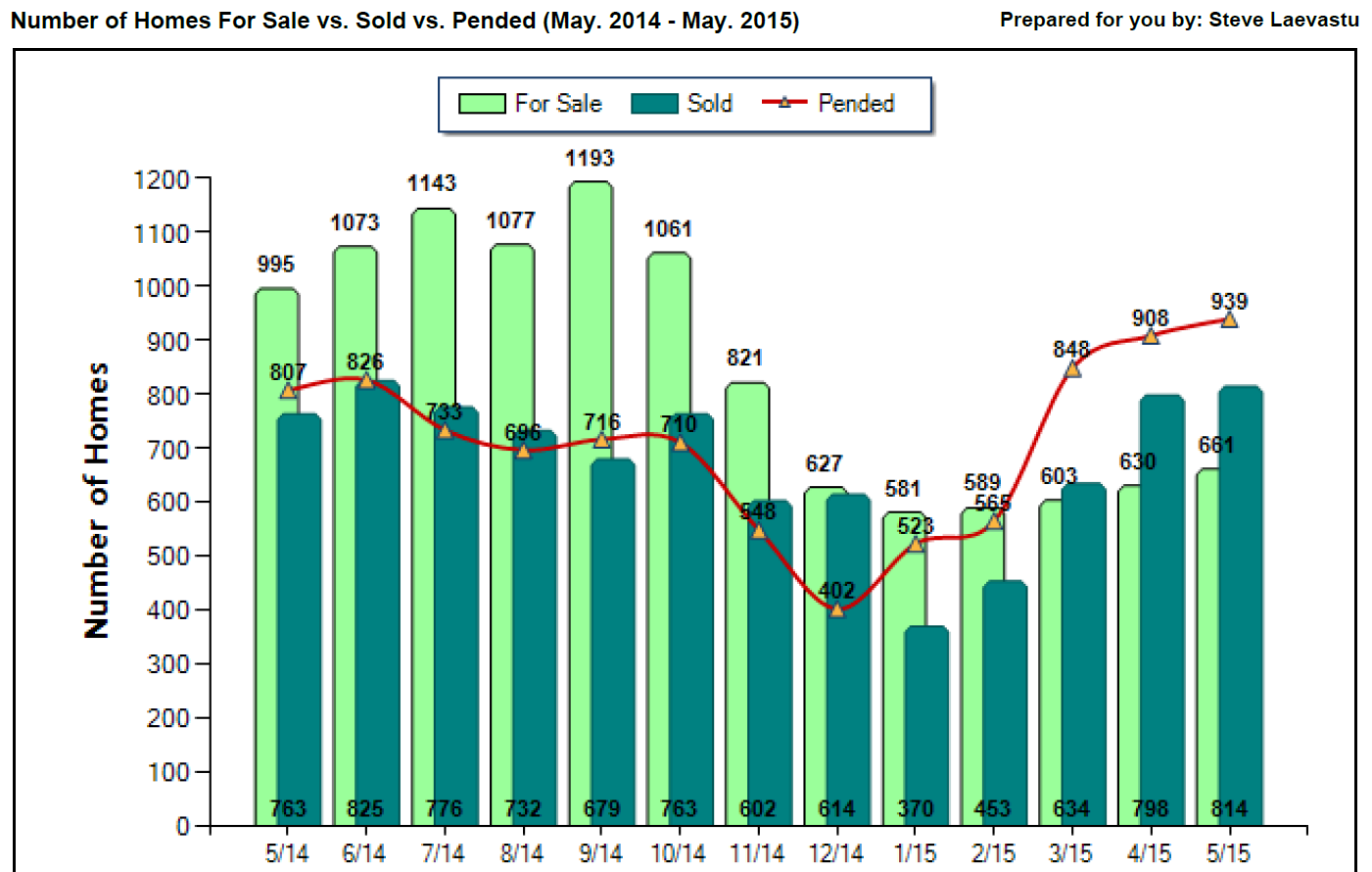

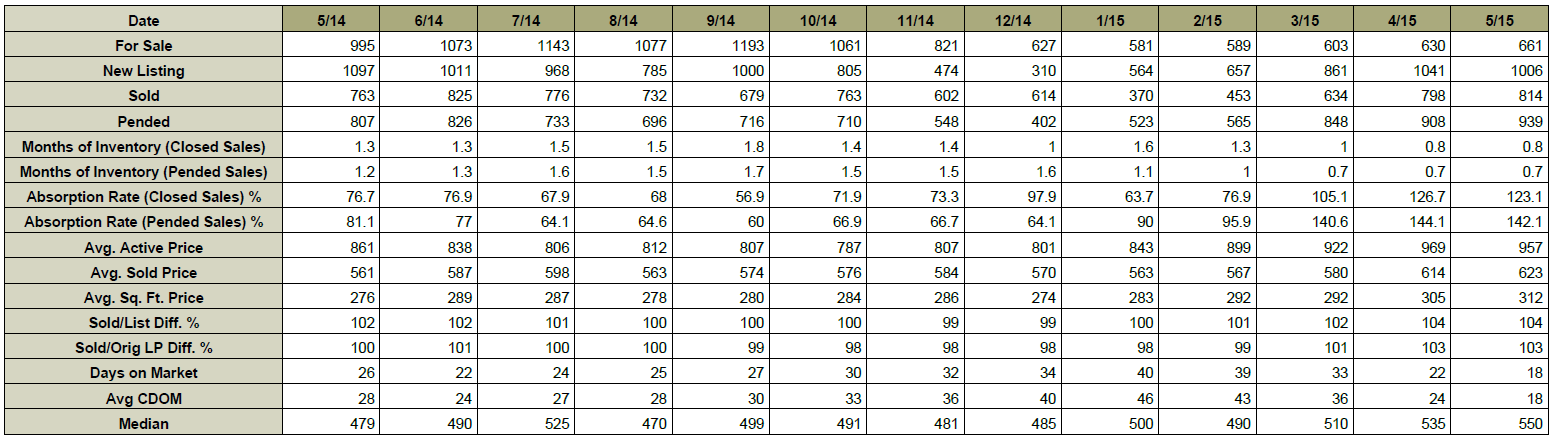

THE CHART AND GRAPH BELOW ARE REAL ESTATE STATISTICS FOR THE CITY OF SEATTLE.

If you have any questions or if I can be of any assistance please contact me.

Thank you,

Steve Laevastu

cell 206-226-5300

January 2016 Seattle Real Estate Update – Another record breaking month

SEATTLE HOUSING MARKET UPDATE

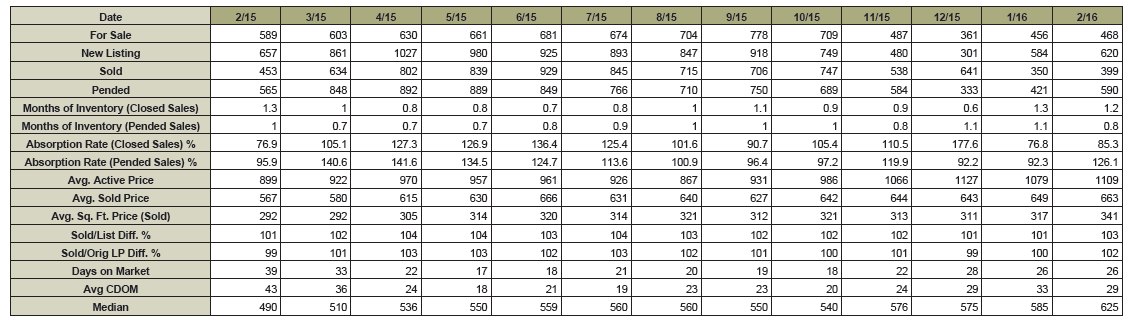

January 2016 was another RECORD SETTING MONTH FOR SEATTLE REAL ESTATE!!!

The median price of a Seattle home is now $585,000. This is a new record.

The old record was set back in November 2015 at $576,000.

The median price of a Seattle home is up 17% vs January 2015.

There were 442 pending sales in January, which is down 15% from twelve months ago when 523 pending sales were reported. The reason pending sales were down is because there is no inventory out there to sell.

SO WHAT HAPPENED TO SEATTLE REAL ESTATE IN JANUARY?

In January there were 456 ACTIVE listings in the Seattle real estate market.

In January 442 homes went PENDING.

Which means that 1 out of every 1.03 homes on the market went pending in January.

This 1.03 ratio implies a 1.03 month supply of inventory.

The 1.03 ratio is a strong SELLER’S MARKET INDICATOR.

THE PAST 13 MONTHS HAVE SEEN THE BEST SELLER RATIOS EVER FOR SEATTLE ABSORPTON RATE.

Any ratio under 3.0 is a seller’s market indicator.

Any ratio between 3.0 and 6.0 is a neutral market indicator.

Any ratio over 6.0 is a buyer’s market indicator.

The story remains LACK OF INVENTORY.

EPIC RECORD SETTING LOW INVENTORY!!!

In January there were 456 ACTIVE listings in Seattle.

The 456 ACTIVE LISTINGS IS THE SECOND LOWEST NUMBER EVER RECORDED.

The record low was set last month (December 2015) with 361 ACTIVE listings.

The 456 ACTIVE listings is 67% under our 10 year average for January inventory.

Another way of looking at it is that we are only at 33% of our average inventory for this time of year.

The January ten year moving average for inventory is 1,381 ACTIVE listings.

Also if we compare January 2016 to January 2015 we will note that even though inventory was low in January 2015 (581) it was even lower in January 2016 (456). Inventory is down 22% vs 2015.

In the month of January the AVERAGE list price vs sales price for Seattle was 101%.

So the average home sold for 1% over the asking price.

This is the 12th month in a row that the AVERAGE list price vs AVERAGE sales price has been over 100%

The AVERAGE days on market for a Seattle home was 26 days before they accepted an offer.

And real estate is always LOCALIZED. What I mean is that CERTAIN areas are moving better than other areas. Let’s take a look at list price vs sales prices for some different neighborhoods in Seattle for the month of January

- Montlake 109%

- Maple Leaf 107%

- Madrona 107%

- Green Lake 106%

- Ravenna 105%

- Wallingford 104%

- Ballard 103%

- West Seattle 103%

- Capitol Hill 102%

- View Ridge and Hawthorne Hills 101%

- Magnolia 101%

- Wedgwood 101%

- Bryant 98%

- Lake City 98%

- Seward Park 94%

- Laurelhurst zero closed sales in January

THE CHART AND GRAPH BELOW ARE REAL ESTATE STATISTICS FOR THE CITY OF SEATTLE.

If you have any questions or if I can be of any assistance please contact me.

Thank you,

Steve Laevastu

cell 206-226-5300

What’s In Store for Seattle in 2016?

Each year I take a look back on the Seattle real estate market and consider what is coming up in the months to come. Here is a snapshot of my 2016 predictions for Seattle’s real estate market:

PRICES: December’s data is not yet available, but median residential home prices in Seattle have risen 13.1% over 2015. That is a significant increase! I don’t expect 2016 to have an increase quite so strong, but I do expect there to continue to be a more moderate increase since we are starting from a higher spot. Housing inventory will continue to be a challenge and a driver in our market, especially as jobs at Amazon, Google, and other tech industries continue to grow and fill the office space available. Although there are new projects and housing available, it will continue to get consumed quickly. Therefore, I predict Seattle home and condo prices to rise between 8- 10% over the next year. They rose from 2012 to 2013: 11.2% and 2013 to 2014: 7.4%.

AFFORDABILITY: I do expect this will be a very hot topic in 2016 especially in Seattle. The areas around South Lake Union, Capitol Hill, Queen Anne, and Belltown will see the highest demand. These are already areas where rent – and prices – are soaring, and the people who are moving in for work may be priced out. First time homebuyers will be priced out of many of these areas (as well as renters if rent increases faster than wages). Therefore, they may be looking in neighborhoods just outside of there (such as Ballard, Greenlake, Leschi, etc) and look to mass transit.

INVENTORY: There were 1,133 homes and condos available for sale last November. This year there were only 739 – a 34.8% decline. The average days on market for a home or condo sold October-December of 2014 was 34. That has declined to 22 in October-December of 2015. There are a number of condo developments on the horizon for 2016, but we need more to house the number of people coming into the area.

According to Seattle.gov, 2010’s population estimate was 608,660 and the population estimate for 2015 is 662,400. This means that within the last five years, we needed to house 53,740 additional people. That is 10,748 per year or 207 people per week. No wonder we have an inventory challenge! The job market is going to continue to be strong in 2016 and more workers will be on the hunt for housing!

ADUs and DADUs: Accessory Dwelling Units (ADUs) and Tiny Accessory Dwelling Units (DADUs) are separate living spaces within a house or on the same property as an existing house which are legally permitted. Mayor Murray put forth his aggressive Housing Affordability and Livability (HALA) plan this past year to create 50,000 housing units over the next ten years. Increasing the number of ADUs and DADUs are on the HALA report for 2016 and I predict that we will see many ADU and DADU units built on lots to increase urban density. These are also referred to as cottage housing, small duplexes, and backyard cottages. There may be an opportunity for you to build an ADU or DADU in your own backyard! You can find out more information on ADUs and DADUs and the HALA report here:

- http://www.seattle.gov/dpd/permits/commonprojects/motherinlawunits/default.htm

- https://www.municode.com/library/wa/seattle/codes/municipal_code?nodeId=TIT23LAUSCO_SUBTITLE_IIILAUSRE_DIV2AUUSDEST_CH23.44RESIMI_SUBCHAPTER_IPRUSPEOU_23.44.016PAGA

- http://murray.seattle.gov/wp-content/uploads/2015/09/MayorsActionPlan_Edited_Sept2015.pdf

INTEREST RATES: The Federal Reserve decided to raise the short term interest rates at their December meeting, which will undoubtedly cause mortgage interest rates to rise over the coming year, perhaps as much as to 5.5%. Although this will affect how much home a buyer can afford, I don’t expect it will diminish demand significantly.

If you would like to learn more about what is in store for 2016 and how what is happening with the real estate market affects your real estate investment, please give me a call or text: (206) 226-5300 or email: sold@windermere.com.

Seattle’s Cranes: An Indicator of Future Growth

Do you know how many construction cranes are towering over Seattle building our future offices, condos, and retail centers? 20? 25? Believe it or not, according to the Rider Levett Bucknall Crane Index, which produces the North American RLB Crane Index, there are 42 cranes hard at work, altering Seattle’s skylines.

The Crane Index is published twice a year. It tracks the number of fixed cranes in major cities across North America and is an indicator of the construction workload in an area. Residential projects currently make up less than half of the craned projects in the Seattle area (Lake Washington to West Seattle and Northgate to Boeing Field). The index does not include Bellevue and Everett. According to the Puget Sound Business Journal, the Boeing 777X facility has 17 cranes on site alone.

It is no secret that this has been the busiest construction period that Downtown Seattle has seen in over a decade. While the RLB Crane Index indicated that the number of cranes decreased in Seattle since their last report at the beginning of the year (by nine), the number is expected to increase again according to the Puget Sound Business Journal. A number of projects have recently broken ground or are in the permitting phase.

What does this mean for the Seattle real estate market?

- An increase in office space and retail space means more employees who will need housing.

- An increase in residential units including apartments and condos will fulfill some of that need.

- An increase in transportation facilities will help people move throughout the region faster, making housing in the outlying areas more attractive.

- Some projects are for medical, hotels, and other infrastructure (such as the Elliott Bay Seawall) which will support Puget Sound residents.

I am excited for what Seattle’s economic future has in store! I predict demand will continue to be high in the coming years. What does this mean for you? Give me a call: (206) 226-5300 or send me an email: sold@windermere.com.

Seattle Housing Market Update – Historic Seller’s Market Continues!

SEATTLE HOUSING MARKET UPDATE

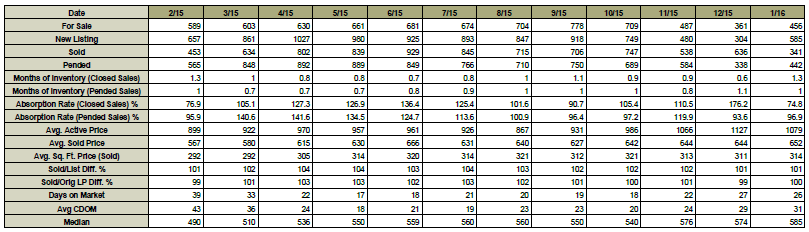

September 2015 was another GREAT MONTH FOR SELLERS IN SEATTLE!!

The median price of a Seattle home is at $551,000. The median price of a Seattle home has remained relatively constant over the past 5 months:

May 2015 = $550,000

June 2015 = $559,000

July 2015 = $560,000

August 2015 = $560,000

September 2015 = $551,000

However, the median price is up 10% vs September 2014 when the median price was $499,000.

There were 774 pending sales in September, which is up 9% from twelve months ago when 716 pending sales were reported.

SO WHAT HAPPENED TO SEATTLE REAL ESTATE IN SEPTEMBER?

In September there were 778 ACTIVE listings in the Seattle real estate market.

In September 774 homes went PENDING.

Which means that 1 out of every 1.005 homes on the market went pending in September.

This 1.005 ratio implies a 1.005 month supply of inventory.

The 1.005 ratio is a strong SELLER’S MARKET INDICATOR.

THE PAST 9 MONTHS HAVE SEEN THE BEST SELLER RATIOS EVER FOR SEATTLE ABSORPTON RATE.

Any ratio under 3.0 is a seller’s market indicator.

Any ratio between 3.0 and 6.0 is a neutral market indicator.

Any ratio over 6.0 is a buyer’s market indicator.

The story remains LACK OF INVENTORY.

In September there were 778 ACTIVE listings in Seattle.

The 778 ACTIVE listings is 62% under our 10 year average for September inventory.

Another way of looking at it is that we are only at 38% of our average inventory for this time of year.

THE 778 ACTIVE listings is the 10th lowest month ever recorded. Slightly higher than the all time low which was set 9 months ago (January 2015) with 581.

Needless to say, the 778 ACTIVE September listings is the lowest number ever recorded for SEPTEMBER in Seattle.

The September ten year moving average for inventory is 2,055 ACTIVE listings.

Also if we compare September 2015 to September 2014 we will note that even though inventory was low in September 2014 (1193) it was even lower in September 2015 (778). Inventory is down 35% vs 2014.

In the month of September the AVERAGE list price vs sales price for Seattle was 102%.

So the average home sold for 2% over the asking price.

This is the 8th month in a row that the AVERAGE list price vs AVERAGE sales price has been over 100%

The AVERAGE days on market for a Seattle home was 19 days before they accepted an offer.

And real estate is always LOCALIZED. What I mean is that CERTAIN areas are moving better than other areas. Let’s take a look at list price vs sales prices for some different neighborhoods in Seattle for the month of September

- Montlake 107%

- Capitol Hill 107%

- Ravenna 106%

- Wedgwood 105%

- Green Lake 105%

- View Ridge & Hawthorne Hills 104%

- Ballard 103%

- Magnolia 103%

- Queen Anne 102%

- West Seattle 102%

- Laurelhurst 101%

- Seward Park 101%

- Lake City 100%

- Madrona 99%

THE CHART AND GRAPH BELOW ARE REAL ESTATE STATISTICS FOR THE CITY OF SEATTLE.

If you have any questions or if I can be of any assistance please contact me.

Thank you,

Steve Laevastu

cell 206-226-5300

sold@windermere.com

Seattle Housing Market – July Sets New Seattle Median Sales Price Record $560,000

SEATTLE HOUSING MARKET UPDATE

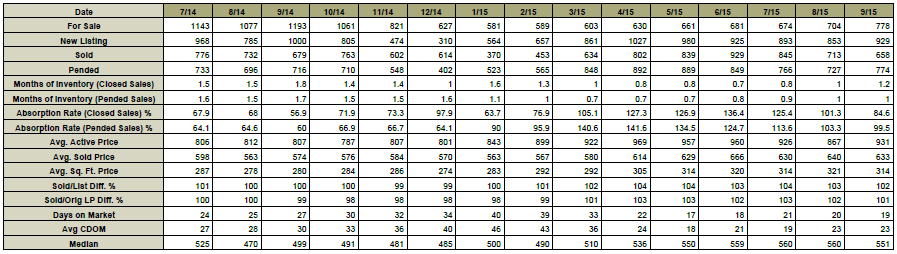

July 2015 set more records for Seattle real estate!

The new report summarizing July activity shows year-over-year gains in pending sales, and prices.

The median price of a Seattle home is now A NEW ALL TIME RECORD $560,000 which is up 9% from one year ago when the median price of a Seattle home was $525,000.

There were 816 pending sales in July, which is up 11% from twelve months ago when 733 pending sales were reported.

SO WHAT HAPPENED TO SEATTLE REAL ESTATE IN JULY?

In July there were 674 ACTIVE listings in the Seattle real estate market.

In July 816 homes went PENDING.

Which means that 1 out of every 0.8 homes on the market went pending in June.

This 0.8 ratio implies a 0.8 month supply of inventory.

The 0.8 ratio is a strong SELLER’S MARKET INDICATOR.

THE PAST 7 MONTHS HAVE SEEN THE BEST SELLER RATIOS EVER FOR SEATTLE ABSORPTION RATE.

Any ratio under 3.0 is a seller’s market indicator.

Any ratio between 3.0 and 6.0 is a neutral market indicator.

Any ratio over 6.0 is a buyer’s market indicator.

The story remains LACK OF INVENTORY.

In July there were 681 ACTIVE listings in Seattle.

The 674 ACTIVE listings is 65% under our 10 year average for July inventory.

Another way of looking at it is that we are only at 35% of our average inventory for this time of year.

THE 674 ACTIVE listings is the 8th lowest month ever recorded. Slightly higher than the all time low which was set 7 months ago (January 2015) with 581.

Needless to say, the 674 ACTIVE July listings is the lowest number ever recorded for JULY in Seattle.

The July ten year moving average for inventory is 1,944 ACTIVE listings.

Also if we compare July 2015 to July 2014 we will note that even though inventory was low in July 2014 (1143) it was even lower in July 2015 (674). Inventory is down 41% vs 2014.

In the month of July the AVERAGE list price vs sales price for Seattle was 104%.

So the average home sold for 4% over the asking price.

This is the 6th month in a row that the AVERAGE list price vs AVERAGE sales price has been over 100%

And real estate is always LOCALIZED. What I mean is that CERTAIN areas are moving better than other areas. Let’s take a look at list price vs sales prices for some different neighborhoods in Seattle for the month of July

- Ravenna 109%

- Wedgwood 106%

- Laurelhurst 106%

- Madrona 106%

- Green Lake 105%

- Ballard 105%

- Beacon Hill 105%

- View Ridge & Hawthorne Hills 104%

- Montlake 104%

- Lake City 104%

- Queen Anne 103%

- Magnolia 103%

- Seward Park 103%

- Capitol Hill 103%

- West Seattle 102%

THE CHART AND GRAPH BELOW ARE REAL ESTATE STATISTICS FOR THE CITY OF SEATTLE.

If you have any questions or if I can be of any assistance please contact me.

Thank you,

Steve Laevastu

cell 206-226-5300

What Population Growth Means for the Seattle Housing Market

My clients have been asking me lately what is causing the huge inventory challenges that we are seeing right now in our real estate market. The number of homes for sale in Seattle and the surrounding area is not only historically low for this time of year, but the demand for this housing is causing prices to escalate rapidly, harkening back to the last housing surge we had before the housing market crashed. There is fear about Seattle developing a bubble. However, it is important to note that the conditions that caused the increases back in 2006-2007 are different than what causing this high demand today.

Back in 2005-2007, a good portion of the housing demand was caused by the ease of obtaining a loan. Not so today. Not only are lending standards much more stringent, but increases in population are one of the key driving factors in the demand for housing. Let’s take a look at what is happening in Washington and Seattle.

The new data provided by the Washington State Office of Financial Management (OFM) will come out in just a few days (June 30th). However, last year’s data released June 30th, 2014 showed that Washington State’s population increased by 85,800 between 2013-2014 (a 1.25% gain) which was the largest one-year increase since 2008.

OFM also indicated that migration from other states was the largest component of this increase (49,200 people net). Natural increases (birth minus death) accounted for the rest of the increase.

Additionally, 75% of the state’s population increase impacted the five largest metropolitan counties: Clark, King, Pierce, Snohomish, and Spokane due to the economic opportunities in those areas.

What is interesting is OFM also reported that 31,000 new housing units were added across the state. Even if you averaged two people per household, there is still a shortage of about 20,000 units. And that is just due to population!

Now let’s take a closer look at Seattle. Between 2010-2014, Seattle’s population grew by 31,840 people. In that same period, 14,823 housing units were added. Again, if we estimate two people per unit, that still gives us about a 2,000 shortage just within Seattle.

I am not concerned about a housing bubble right now. The demand we are seeing is a natural component of a strong economy and increases in population. However, if you have concerns, I would be happy to talk with you about those. Give me a call at (206) 226-5300 or send an email to sold@windermere.com.

Seattle Median Sales Price Sets NEW RECORD IN MAY!

SEATTLE HOUSING MARKET UPDATE

May 2015 set more records for Seattle real estate!

The new report summarizing May activity shows year-over-year gains in pending sales, and prices.

The median price of a Seattle home is now A NEW ALL TIME RECORD $550,000 which is up 15% from one year ago when the median price of a Seattle home was $479,000.

There were 939 pending sales in May, which is up 16% from twelve months ago when 807 pending sales were reported.

SO WHAT HAPPENED TO SEATTLE REAL ESTATE IN MAY?

In May there were 661 ACTIVE listings in the Seattle real estate market.

In May 939 homes went PENDING.

Which means that 1 out of every 0.7039 homes on the market went pending in May.

This 0.7039 ratio implies a 0.7039 month supply of inventory.

The 0.7039 ratio is a strong SELLER’S MARKET INDICATOR.

THE PAST 4 MONTHS HAVE SEEN THE BEST SELLER RATIOS EVER FOR SEATTLE ABSORPTON RATE.

Any ratio under 3.0 is a seller’s market indicator.

Any ratio between 3.0 and 6.0 is a neutral market indicator.

Any ratio over 6.0 is a buyer’s market indicator.

The story remains LACK OF INVENTORY.

In May there were 661 ACTIVE listings in Seattle.

The 661 ACTIVE listings is 64% under our 10 year average for May inventory.

Another way of looking at it is that we are only at 36% of our average inventory for this time of year.

THE 661 ACTIVE listings is the 5th lowest month ever. Slightly higher than the all time low which was set five months ago (January 2015) with 581.

The May ten year moving average for inventory is 1,828 ACTIVE listings.

Also if we compare May 2015 to May 2014 we will note that even though inventory was low in May 2014 (995) it was even lower in May 2015 (661). Inventory is down 33% vs 2015.

In the month of May the AVERAGE list price vs sales price for Seattle was 104%.

So the average home sold for 4% over the asking price.

The 104% list price vs sales for Seattle TIED THE RECORD!!!

The 104% record was originally set last month (April 2015).

The past 2 months in a row have seen the average list price vs sales price in Seattle at 104%

And real estate is always LOCALIZED. What I mean is that CERTAIN areas are moving better than other areas. Let’s take a look at list price vs sales prices for some different neighborhoods in Seattle for the month of May

- Wedgwood 113%

- Ravenna 113%

- Green Lake 107%

- Capitol Hill 106%

- Montlake 105%

- Ballard 105%

- View Ridge & Hawthorne Hills 104%

- West Seattle 104%

- Queen Anne 103%

- Magnolia 102%

- Beacon Hill 102%

- Seward Park 102%

- Lake City 101%

- Laurelhurst 100%

- Madrona 97%

THE CHART AND GRAPH BELOW ARE REAL ESTATE STATISTICS FOR THE CITY OF SEATTLE.

If you have any questions or if I can be of any assistance please contact me.

Thank you,

Steve Laevastu

cell 206-226-5300