According to the National Association of REALTORS®, over the last five years in the Seattle Metro area, rents have increased a whopping 22.26% between whereas wages for 25-44 year olds (which comprise a good number of renters) only increased 15.3%. This time period reviewed was quarter 3 2009 to quarter 3 2014 for the rents whereas wages were reviewed 2009-2014. According to Dupre+Scott Apartment Advisors, that number is even more staggering when looking only at Seattle and since spring of 2013 – 18% higher.

This disparity along with comparisons to tech-driven job markets such as San Francisco have many wondering if Seattle could be the next city to jump on the rent control bandwagon.

According to the Puget Sound Business Journal, there was a town meeting at City Hall on April 23rd to discuss this hot topic and Mayor Ed Murray has even created a housing affordability task force to tackle the problem. The hurdle is a big one – rent control is currently illegal in Washington State.

Seattle Magazine reports that renters make up 52% of Seattle’s population, so the effects of such a law – or not passing a law – will be felt by the majority of Seattle’s residents. With the average market rent for a one bedroom, one bathroom apartment in the city of Seattle going for $1,445 per month, there are a number of renters and would-be renters who are going to have to start finding housing further away from the city center.

People for rent control point to issues like transportation that become a bigger challenge when workers cannot afford to live near where they work and have to commute in. However, those who oppose it indicate that rent control will hamper development and reinvestment in the buildings that may be in need of updating.

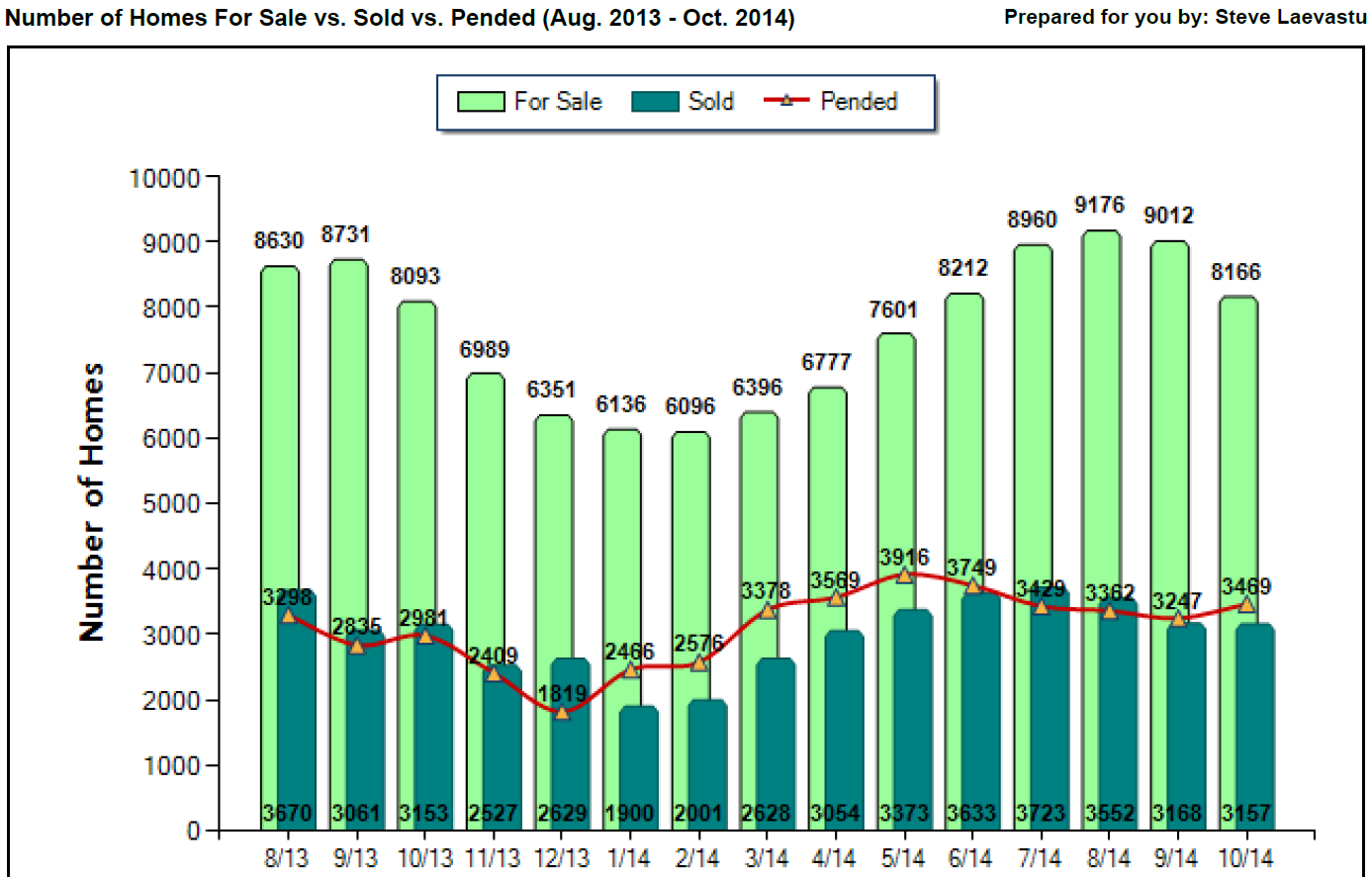

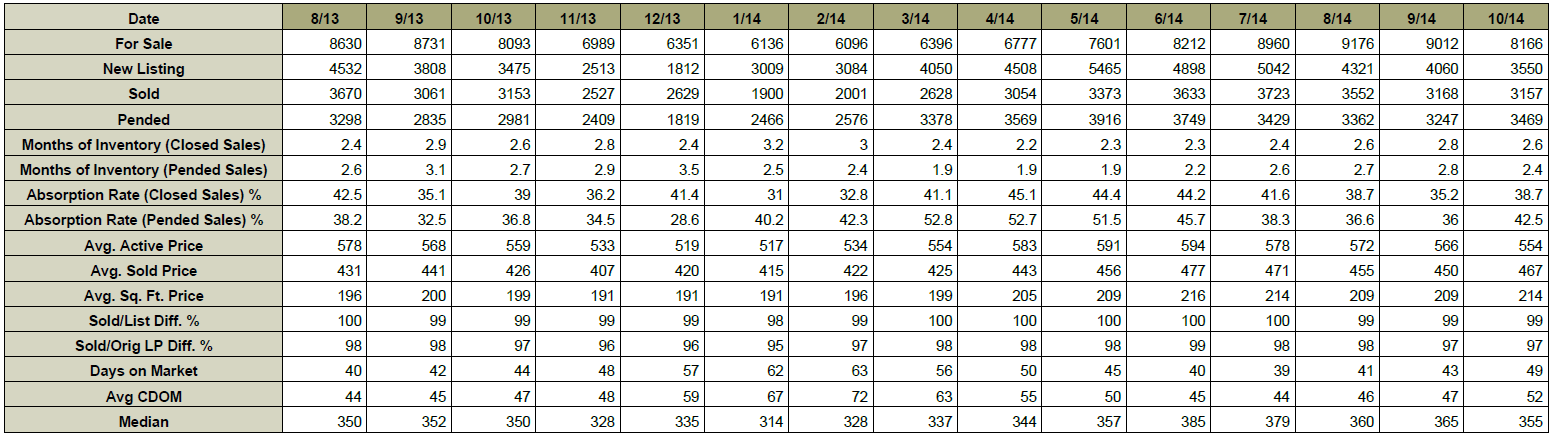

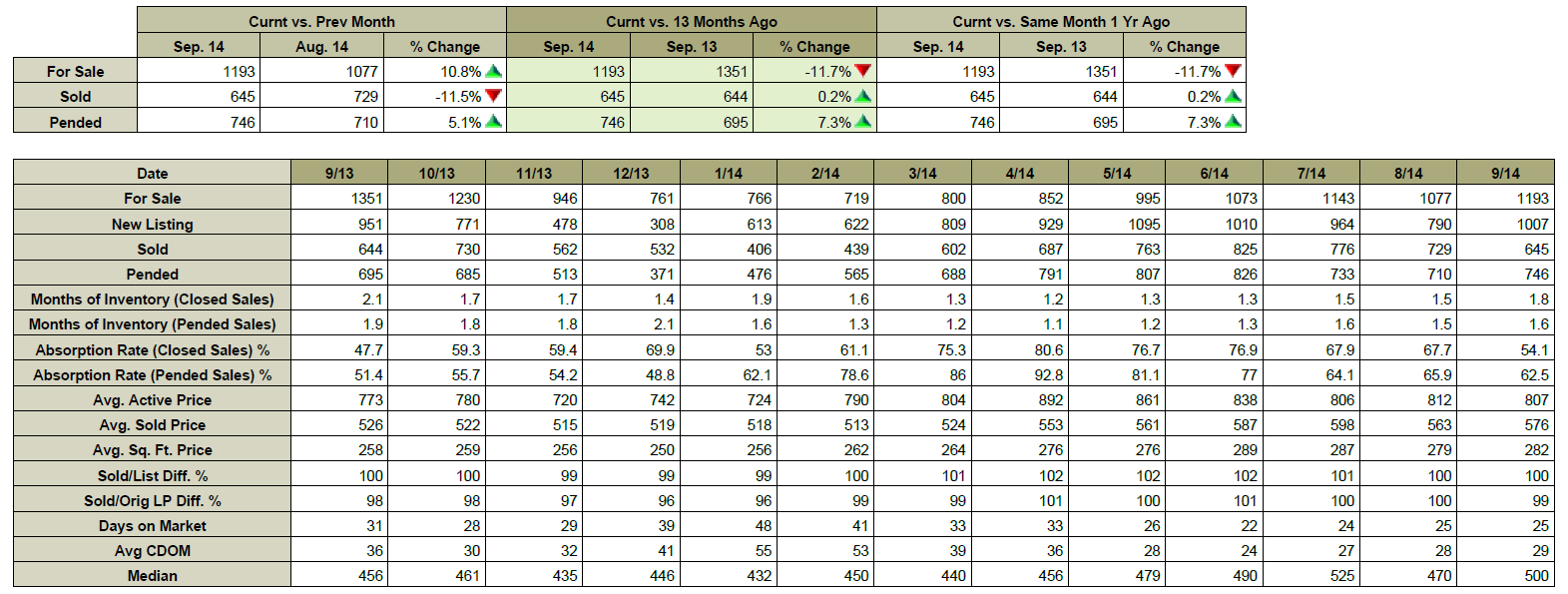

Whether you are a proponent of rent control or not, this debate and rent increases are driving some to turn to home ownership, even with the inventory shortages that challenging the real estate market.

However, the economics of it make sense. If you are paying $3,000 per month for a three bedroom apartment in Capitol Hill and you can buy a 3 bedroom home in Wallingford for $600,000 (even taking into account multiple offers driving up the price from $500,000 to $600,000), depending on your down payment, that mortgage and principle may only come to $2,300 per month. Add taxes and insurance on there and you might be at $2,800 per month. Remember, this is just an estimation, and prices vary, but if you are pounding your fist, hoping rent control is passed before your landlord decides to raise the rent again, you owe it to yourself to take a look at home ownership.

And remember! If you have a 30 year fixed rate mortgage, your monthly mortgage payment is your monthly mortgage payment – next year and 25 years down the road. Furthermore, you are building equity which could mean money in your pocket when you are ready to sell. Try doing that while renting!

I would be happy to give you additional information on how to make your housing dollars go further. Give me a call: (206) 226-5300 or send an email to: sold@windermere.com!