With median sales prices continuing to rise (median sales prices for Seattle residential in February were 26.3% over February 2015 and 38.9% over February 2014). There is speculation about a bubble developing in the real estate market with over-inflated prices that are going to pop. Continue reading

Category Archives: Seattle Real Estate Trends

Seattle Real Estate Trends: February 2016

Mariners baseball is starting in just a few weeks, the tulips are up, and all my listings are pending! Let’s see what happened in Seattle’s February real estate market in key neighborhoods:

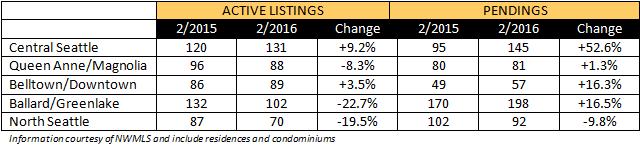

Inventory and Pendings

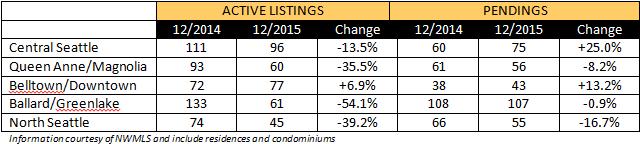

Below we compare the number of active listings (supply) and pendings (demand) for several of the key Seattle neighborhoods including Central Seattle, Queen Anne and Magnolia, Belltown and Downtown, Ballard and Greenlake, and North Seattle. Our table includes single family residences as well as condos comparing February 2015 and 2016.

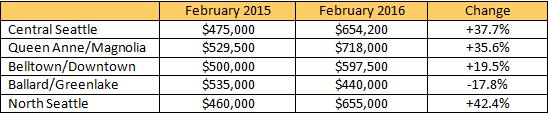

Median Sales Prices

Median sales prices are up quite dramatically in some areas comparing February 2015 versus February 2016 numbers. See the tables below!

With the number of sales dropping in some areas due to lack of inventory, median sales price adjustments may get more pronounced. For example, in North Seattle, the number of sales dropped from 81 last February to 65 this February. However, in Ballard/Greenlake, the sales went from 119 last year to 189. Belltown went from 23 last year to 40 this year. Queen Anne/Magnolia was about at par with 69 sales last year and 71 this year. Central Seattle went from 105 to 83.

In Ballard/Greenlake, there were several lower-priced properties that sold that might be skewing the median a bit. The Cove at Verdian counted for 8 of the 189 sales, all under $239,000. In addition the Vik condo project accounted for 64 sales, ranging from to $261,900 to $755,900.

Just like in Belltown last summer with the Ensignia project, as inventory is low and a buildings-worth of new product comes on the market, I expect median home prices to skew based on the pricing in the development.

The median home price for February in all of Seattle for both residential and condos was $511,000, which is 16.1% above last February’s $440,000. February had 695 listings available on the market and as of this writing, there are 747 active listings, which is good for our market.

If you would like to learn more about what is happening in your neighborhood, let’s talk! Please contact me – your Seattle Home Guy – at sold@windermere.com or give me a call: (206) 226-5300.

Seattle Real Estate Trends – January 2016

It already feels a little spring-like in Seattle. Trees are beginning to bloom, the days are getting longer, and the real estate market never even took a breath in the winter. Let’s see what happened in Seattle’s January real estate market in key neighborhoods:

Inventory and Pendings

Below we compare the number of active listings (supply) and pendings (demand) for several of the key Seattle neighborhoods including Central Seattle, Queen Anne and Magnolia, Belltown and Downtown, Ballard and Greenlake, and North Seattle. Our table includes single family residences as well as condos comparing January 2015 and 2016.

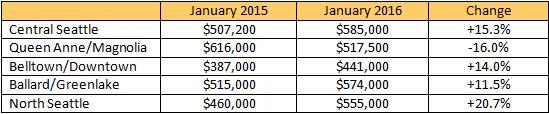

Median Sales Prices

Prices are mostly up looking at January 2015 versus January 2016 numbers. See the tables below!

The median home price for January in all of Seattle for both residential and condos was $520,000, which is 15.0% above last January’s $452,000. I was glad to see the amount of available inventory go up in January, from 548 in December to 659 this month. Last January actually had fewer listings than December, so it was good to see this shift as buyers are out in droves.

If you are thinking of a move this year, let’s talk! Please contact me – your Seattle Home Guy – at sold@windermere.com or give me a call: (206) 226-5300.

January 2016 Seattle Real Estate Update – Another record breaking month

SEATTLE HOUSING MARKET UPDATE

January 2016 was another RECORD SETTING MONTH FOR SEATTLE REAL ESTATE!!!

The median price of a Seattle home is now $585,000. This is a new record.

The old record was set back in November 2015 at $576,000.

The median price of a Seattle home is up 17% vs January 2015.

There were 442 pending sales in January, which is down 15% from twelve months ago when 523 pending sales were reported. The reason pending sales were down is because there is no inventory out there to sell.

SO WHAT HAPPENED TO SEATTLE REAL ESTATE IN JANUARY?

In January there were 456 ACTIVE listings in the Seattle real estate market.

In January 442 homes went PENDING.

Which means that 1 out of every 1.03 homes on the market went pending in January.

This 1.03 ratio implies a 1.03 month supply of inventory.

The 1.03 ratio is a strong SELLER’S MARKET INDICATOR.

THE PAST 13 MONTHS HAVE SEEN THE BEST SELLER RATIOS EVER FOR SEATTLE ABSORPTON RATE.

Any ratio under 3.0 is a seller’s market indicator.

Any ratio between 3.0 and 6.0 is a neutral market indicator.

Any ratio over 6.0 is a buyer’s market indicator.

The story remains LACK OF INVENTORY.

EPIC RECORD SETTING LOW INVENTORY!!!

In January there were 456 ACTIVE listings in Seattle.

The 456 ACTIVE LISTINGS IS THE SECOND LOWEST NUMBER EVER RECORDED.

The record low was set last month (December 2015) with 361 ACTIVE listings.

The 456 ACTIVE listings is 67% under our 10 year average for January inventory.

Another way of looking at it is that we are only at 33% of our average inventory for this time of year.

The January ten year moving average for inventory is 1,381 ACTIVE listings.

Also if we compare January 2016 to January 2015 we will note that even though inventory was low in January 2015 (581) it was even lower in January 2016 (456). Inventory is down 22% vs 2015.

In the month of January the AVERAGE list price vs sales price for Seattle was 101%.

So the average home sold for 1% over the asking price.

This is the 12th month in a row that the AVERAGE list price vs AVERAGE sales price has been over 100%

The AVERAGE days on market for a Seattle home was 26 days before they accepted an offer.

And real estate is always LOCALIZED. What I mean is that CERTAIN areas are moving better than other areas. Let’s take a look at list price vs sales prices for some different neighborhoods in Seattle for the month of January

- Montlake 109%

- Maple Leaf 107%

- Madrona 107%

- Green Lake 106%

- Ravenna 105%

- Wallingford 104%

- Ballard 103%

- West Seattle 103%

- Capitol Hill 102%

- View Ridge and Hawthorne Hills 101%

- Magnolia 101%

- Wedgwood 101%

- Bryant 98%

- Lake City 98%

- Seward Park 94%

- Laurelhurst zero closed sales in January

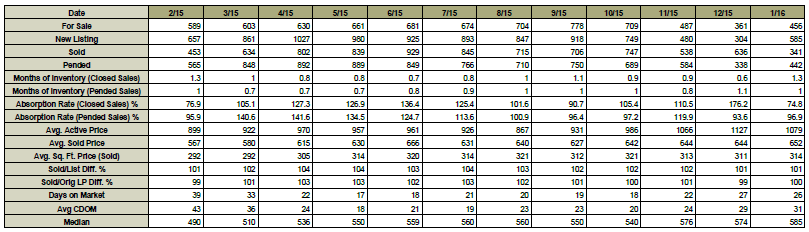

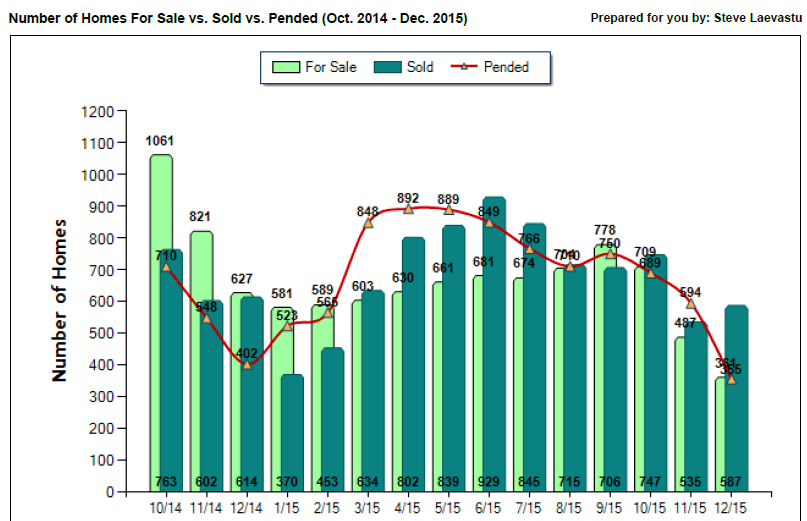

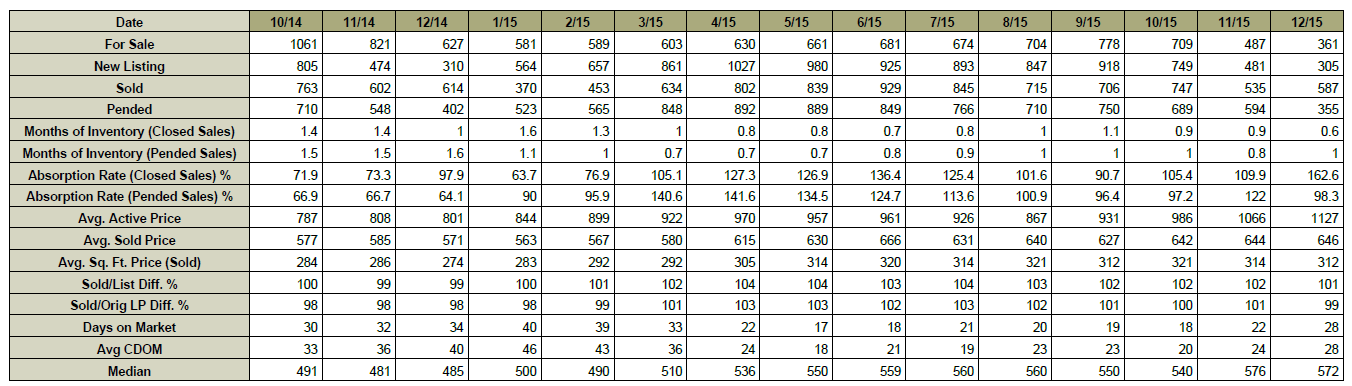

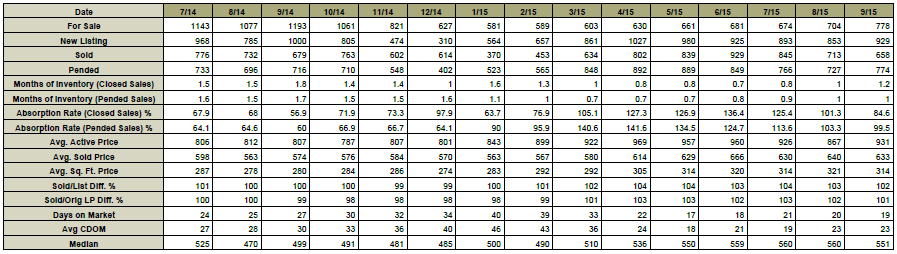

THE CHART AND GRAPH BELOW ARE REAL ESTATE STATISTICS FOR THE CITY OF SEATTLE.

If you have any questions or if I can be of any assistance please contact me.

Thank you,

Steve Laevastu

cell 206-226-5300

Seattle Real Estate Trends, December 2015

This 2016 is starting with the lowest number of homes for sale in Seattle in years! In December there were only 359 homes and condos for sale in all of Seattle. Let’s see what happened in Seattle’s November real estate market in key neighborhoods:

Inventory and Pendings

Below we compare the number of active listings (supply) and pendings (demand) for several of the key Seattle neighborhoods including Central Seattle, Queen Anne and Magnolia, Belltown and Downtown, Ballard and Greenlake, and North Seattle. Our table includes single family residences as well as condos comparing December 2014 and 2015.

Median Sales Prices

Prices are up both year over year and month over month. See the tables below!

I predict that 2016 will be another banner year in Seattle real estate, and I am hopeful that when interest rates start to go up our market will even back out in terms of supply and demand. Have a question about what to do about what to do with your real estate this year? Please contact me – your Seattle Home Guy – at sold@windermere.com or give me a call: (206) 226-5300.

Seattle Housing Market UPDATE – RECORD LOW INVENTORY!

SEATTLE HOUSING MARKET UPDATE

December 2015 was another RECORD SETTING MONTH FOR SEATTLE REAL ESTATE!!!

The median price of a Seattle home is now $572,000. This is the 2nd highest of all time.

The record was set last month (November 2015) at $576,000.

The median price of a Seattle home is up 18% vs December 2014.

There were 355 pending sales in December, which is down 13% from twelve months ago when 402 pending sales were reported. The reason pending sales were down is because there is no inventory out there to sell.

SO WHAT HAPPENED TO SEATTLE REAL ESTATE IN DECEMBER?

In December there were 361 ACTIVE listings in the Seattle real estate market.

In December 355 homes went PENDING.

Which means that 1 out of every 1.02 homes on the market went pending in December.

This 1.02 ratio implies a 1.02 month supply of inventory.

The 1.02 ratio is a strong SELLER’S MARKET INDICATOR.

THE PAST 12 MONTHS HAVE SEEN THE BEST SELLER RATIOS EVER FOR SEATTLE ABSORPTON RATE.

Any ratio under 3.0 is a seller’s market indicator.

Any ratio between 3.0 and 6.0 is a neutral market indicator.

Any ratio over 6.0 is a buyer’s market indicator.

The story remains LACK OF INVENTORY.

EPIC RECORD SETTING LOW INVENTORY!!!

In December there were 361 ACTIVE listings in Seattle.

The 361 ACTIVE LISTINGS IS AN ALL TIME RECORD LOW FOR SEATTLE INVENTORY.

The previous record low was 487 which was recorded in last month (November 2015)

The 361 ACTIVE listings is 74% under our 10 year average for December inventory.

Another way of looking at it is that we are only at 26% of our average inventory for this time of year.

The December ten year moving average for inventory is 1,373 ACTIVE listings.

Also if we compare December 2015 to December 2014 we will note that even though inventory was low in December 2014 (627) it was even lower in December 2015 (361). Inventory is down 43% vs 2014.

In the month of December the AVERAGE list price vs sales price for Seattle was 101%.

So the average home sold for 1% over the asking price.

This is the 11th month in a row that the AVERAGE list price vs AVERAGE sales price has been over 100%

The AVERAGE days on market for a Seattle home was 28 days before they accepted an offer.

And real estate is always LOCALIZED. What I mean is that CERTAIN areas are moving better than other areas. Let’s take a look at list price vs sales prices for some different neighborhoods in Seattle for the month of December

- Wedgwood 106%

- Wallingford 104%

- Ballard 104%

- Maple Leaf 103%

- Magnolia 103%

- Ravenna 102%

- Queen Anne 102%

- Capitol Hill 102%

- Madrona 102%

- View Ridge & Hawthorne Hills 101%

- Bryant 101%

- Seward Park 101%

- West Seattle 101%

- Laurelhurst 100%

- Green Lake 100%

- Montlake 99%

- Lake City 99%

THE CHART AND GRAPH BELOW ARE REAL ESTATE STATISTICS FOR THE CITY OF SEATTLE.

If you have any questions or if I can be of any assistance please contact me.

Thank you,

Steve Laevastu

cell 206-226-5300

What’s In Store for Seattle in 2016?

Each year I take a look back on the Seattle real estate market and consider what is coming up in the months to come. Here is a snapshot of my 2016 predictions for Seattle’s real estate market:

PRICES: December’s data is not yet available, but median residential home prices in Seattle have risen 13.1% over 2015. That is a significant increase! I don’t expect 2016 to have an increase quite so strong, but I do expect there to continue to be a more moderate increase since we are starting from a higher spot. Housing inventory will continue to be a challenge and a driver in our market, especially as jobs at Amazon, Google, and other tech industries continue to grow and fill the office space available. Although there are new projects and housing available, it will continue to get consumed quickly. Therefore, I predict Seattle home and condo prices to rise between 8- 10% over the next year. They rose from 2012 to 2013: 11.2% and 2013 to 2014: 7.4%.

AFFORDABILITY: I do expect this will be a very hot topic in 2016 especially in Seattle. The areas around South Lake Union, Capitol Hill, Queen Anne, and Belltown will see the highest demand. These are already areas where rent – and prices – are soaring, and the people who are moving in for work may be priced out. First time homebuyers will be priced out of many of these areas (as well as renters if rent increases faster than wages). Therefore, they may be looking in neighborhoods just outside of there (such as Ballard, Greenlake, Leschi, etc) and look to mass transit.

INVENTORY: There were 1,133 homes and condos available for sale last November. This year there were only 739 – a 34.8% decline. The average days on market for a home or condo sold October-December of 2014 was 34. That has declined to 22 in October-December of 2015. There are a number of condo developments on the horizon for 2016, but we need more to house the number of people coming into the area.

According to Seattle.gov, 2010’s population estimate was 608,660 and the population estimate for 2015 is 662,400. This means that within the last five years, we needed to house 53,740 additional people. That is 10,748 per year or 207 people per week. No wonder we have an inventory challenge! The job market is going to continue to be strong in 2016 and more workers will be on the hunt for housing!

ADUs and DADUs: Accessory Dwelling Units (ADUs) and Tiny Accessory Dwelling Units (DADUs) are separate living spaces within a house or on the same property as an existing house which are legally permitted. Mayor Murray put forth his aggressive Housing Affordability and Livability (HALA) plan this past year to create 50,000 housing units over the next ten years. Increasing the number of ADUs and DADUs are on the HALA report for 2016 and I predict that we will see many ADU and DADU units built on lots to increase urban density. These are also referred to as cottage housing, small duplexes, and backyard cottages. There may be an opportunity for you to build an ADU or DADU in your own backyard! You can find out more information on ADUs and DADUs and the HALA report here:

- http://www.seattle.gov/dpd/permits/commonprojects/motherinlawunits/default.htm

- https://www.municode.com/library/wa/seattle/codes/municipal_code?nodeId=TIT23LAUSCO_SUBTITLE_IIILAUSRE_DIV2AUUSDEST_CH23.44RESIMI_SUBCHAPTER_IPRUSPEOU_23.44.016PAGA

- http://murray.seattle.gov/wp-content/uploads/2015/09/MayorsActionPlan_Edited_Sept2015.pdf

INTEREST RATES: The Federal Reserve decided to raise the short term interest rates at their December meeting, which will undoubtedly cause mortgage interest rates to rise over the coming year, perhaps as much as to 5.5%. Although this will affect how much home a buyer can afford, I don’t expect it will diminish demand significantly.

If you would like to learn more about what is in store for 2016 and how what is happening with the real estate market affects your real estate investment, please give me a call or text: (206) 226-5300 or email: sold@windermere.com.

Seattle Real Estate Trends, Nov 2015

Usually things quiet down a bit this time of year, especially between Thanksgiving and Christmas. Not so in 2015! Buyers who were frustrated this summer due to not winning with multiple offers are back, hoping to buy while there is a slight lull and before interest rates go up. However, we aren’t seeing the bump in available inventory this late fall. In fact, in November, we dropped to the lowest number of homes and condos available for sale in the last ten years at 740 units. The number of homes under contract for November was 821 which means that properties are still flying off the market very quickly and the demand cannot be satiated!

Let’s see what happened to Seattle’s real estate market in key neighborhoods this November:

Inventory and Pendings

Below we compare the number of active listings (supply) and pendings (demand) for several of the key Seattle neighborhoods including Central Seattle, Queen Anne and Magnolia, Belltown and Downtown, Ballard and Greenlake, and North Seattle. Our table includes single family residences as well as condos comparing September 2014 and 2015.

Median Sales Prices

Prices are still on the rise. November’s median home price for residential and condos was $513,600 – a 17% increase over last November. 17%! In fact, the only month ever with a higher median sold price was this last August at $536,000.

I do expect the Federal Reserve will be raising rates in December, and although that might give buyers some breathing room due to less competition, there is still a lot of pent up demand (and still-growing demand due to our local economy) to be satisfied before we can resume a more-normal market.

My predictions will be out soon for 2016 and if you would like to receive those by mail, please contact me – your Seattle Home Guy – at sold@windermere.com or give me a call: (206) 226-5300.

Seattle Real Estate Market Update, October 2015

Inventory of Seattle of homes for sale is still at a ten year low for October at 1,018 homes and condos available for sale. The ten year average up to 2014 is 2,879 homes which puts us 64.6% below that average. Our pending listings were at 985 for October, which is above our 802 average (22.8% above average).

Let’s see what happened in the October Seattle real estate market in key neighborhoods:

Inventory and Pendings

Below we compare the number of active listings (supply) and pendings (demand) for several of the key Seattle neighborhoods including Central Seattle, Queen Anne and Magnolia, Belltown and Downtown, Ballard and Greenlake, and North Seattle. Our table includes single family residences as well as condos comparing September 2014 and 2015.

Median Sales Prices

Seattle residential and condo median home prices continued to see median sales price increase of 8.9% over last October to a price of $485,000.

The average days on market for sold residential and condos in October was 18 days. This includes properties up to $5,750,000 (the highest price sale in October). This is one day less than September’s sales. Last October, the average days on market in Seattle was 32, so we have had a 43.8% decline in days on market over the last year. That is remarkable!

While the Seattle real estate market appears to be undefeated, I wish I could say the same for the Seahawks. However, like the real estate market, I expect great things in the coming weeks! We are only half way through the season and eight games to go and you can bet I show up in my team blue each Friday and I hope you do too. Go Hawks!

Please contact me – your Seattle Home Guy – at sold@windermere.com or give me a call: (206) 226-5300 to discuss what this market means for you.

Seattle Housing Market Update – Historic Seller’s Market Continues!

SEATTLE HOUSING MARKET UPDATE

September 2015 was another GREAT MONTH FOR SELLERS IN SEATTLE!!

The median price of a Seattle home is at $551,000. The median price of a Seattle home has remained relatively constant over the past 5 months:

May 2015 = $550,000

June 2015 = $559,000

July 2015 = $560,000

August 2015 = $560,000

September 2015 = $551,000

However, the median price is up 10% vs September 2014 when the median price was $499,000.

There were 774 pending sales in September, which is up 9% from twelve months ago when 716 pending sales were reported.

SO WHAT HAPPENED TO SEATTLE REAL ESTATE IN SEPTEMBER?

In September there were 778 ACTIVE listings in the Seattle real estate market.

In September 774 homes went PENDING.

Which means that 1 out of every 1.005 homes on the market went pending in September.

This 1.005 ratio implies a 1.005 month supply of inventory.

The 1.005 ratio is a strong SELLER’S MARKET INDICATOR.

THE PAST 9 MONTHS HAVE SEEN THE BEST SELLER RATIOS EVER FOR SEATTLE ABSORPTON RATE.

Any ratio under 3.0 is a seller’s market indicator.

Any ratio between 3.0 and 6.0 is a neutral market indicator.

Any ratio over 6.0 is a buyer’s market indicator.

The story remains LACK OF INVENTORY.

In September there were 778 ACTIVE listings in Seattle.

The 778 ACTIVE listings is 62% under our 10 year average for September inventory.

Another way of looking at it is that we are only at 38% of our average inventory for this time of year.

THE 778 ACTIVE listings is the 10th lowest month ever recorded. Slightly higher than the all time low which was set 9 months ago (January 2015) with 581.

Needless to say, the 778 ACTIVE September listings is the lowest number ever recorded for SEPTEMBER in Seattle.

The September ten year moving average for inventory is 2,055 ACTIVE listings.

Also if we compare September 2015 to September 2014 we will note that even though inventory was low in September 2014 (1193) it was even lower in September 2015 (778). Inventory is down 35% vs 2014.

In the month of September the AVERAGE list price vs sales price for Seattle was 102%.

So the average home sold for 2% over the asking price.

This is the 8th month in a row that the AVERAGE list price vs AVERAGE sales price has been over 100%

The AVERAGE days on market for a Seattle home was 19 days before they accepted an offer.

And real estate is always LOCALIZED. What I mean is that CERTAIN areas are moving better than other areas. Let’s take a look at list price vs sales prices for some different neighborhoods in Seattle for the month of September

- Montlake 107%

- Capitol Hill 107%

- Ravenna 106%

- Wedgwood 105%

- Green Lake 105%

- View Ridge & Hawthorne Hills 104%

- Ballard 103%

- Magnolia 103%

- Queen Anne 102%

- West Seattle 102%

- Laurelhurst 101%

- Seward Park 101%

- Lake City 100%

- Madrona 99%

THE CHART AND GRAPH BELOW ARE REAL ESTATE STATISTICS FOR THE CITY OF SEATTLE.

If you have any questions or if I can be of any assistance please contact me.

Thank you,

Steve Laevastu

cell 206-226-5300

sold@windermere.com