Even though prices in the Seattle markets are continuing to climb, this can be a great time to sell your home and “buy up”. Often when a home seller “buys up” he or she purchases a home that is 1.5 times the value of the current home. So if a seller’s home has a market value of $400,000, their next home will likely be $600,000.

For this example, let’s assume a homeowner owns a home in Queen Anne with a market value of $500,000 purchased eight years ago for $300,000. He put 20% down and he is paying 5.75% for a 30 year fixed rate loan:

His goal is to buy a home in Ballard valued at $750,000 and he qualifies for 4.0% interest rate on a 30 year fixed rate mortgage:

The above assumes all equity from previous home sale minus 7% of sale price for home selling expenses has been put towards this purchase.

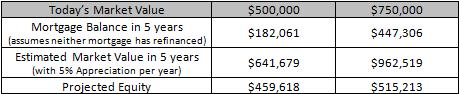

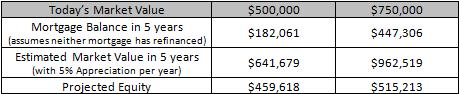

Now, let’s look five years into the future and make some assumptions regarding appreciation. Assuming the Seattle area appreciates at an average of 5% per year, let’s compare his investments if he had stayed in the same $500,000 home with the same mortgage versus if he moved up to the $750,000 home:

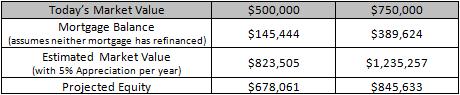

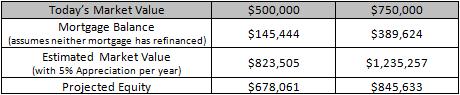

Wow! Both the reduction in the mortgage interest rate plus appreciation on the higher-priced home meant more equity! Now let’s project out ten years using the same variables:

Of course, these are not a guarantee that an investment will perform as illustrated here, but the value of compounding interest (both on the mortgage and on appreciation) should not be underestimated. Please give me a call at (206) 226-5300 or send an email to sold@windermere.com to learn more and strategize your next move.

Mortgage examples are for illustrative use only and are not an offer for a mortgage nor an indication that reader qualifies for such mortgage. Future market value amounts are examples of what could happen and are not a guarantee of future performance. Agent is not responsible for any financial losses that occur as a result of investments made as a result of this publication.