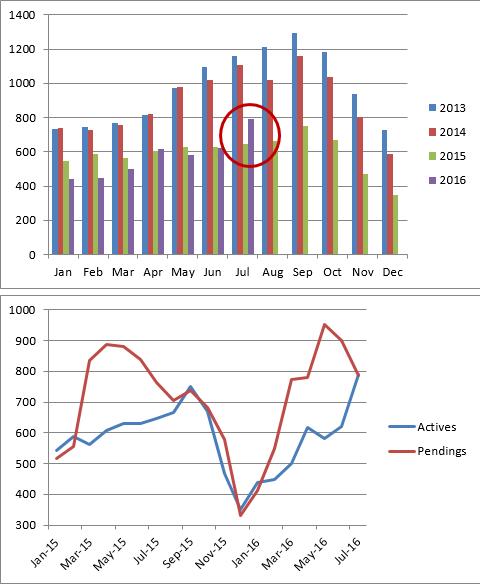

Although Seattle is still faced with higher demand than we have listings for, things changed just a little bit last month. As you can see from the chart right which shows Seattle’s inventory of single family residences, the number of homes for sale exceeded July of 2015 by more than a marginal amount.

Although Seattle is still faced with higher demand than we have listings for, things changed just a little bit last month. As you can see from the chart right which shows Seattle’s inventory of single family residences, the number of homes for sale exceeded July of 2015 by more than a marginal amount.

Tag Archives: property investing

The Future of Puget Sound Area Traffic

Sound Transit has put forth an ambitious plan, called the Sound Transit 3 Plan, to extend Light Rail service throughout the Puget Sound area. The plan is currently receiving public feedback from a number of neighborhood meetings being held throughout the different neighborhoods that will be affected. The finalized plan may be on the ballot in November. All residents (not just homeowners – renters too!) need to be aware of the expansion plan, the timeline, and the bottom line. I encourage you to go to one of the live meetings if you are able to do so. Continue reading

No Bubble for Seattle Real Estate Market

With median sales prices continuing to rise (median sales prices for Seattle residential in February were 26.3% over February 2015 and 38.9% over February 2014). There is speculation about a bubble developing in the real estate market with over-inflated prices that are going to pop. Continue reading

Could Rent Control be coming to Seattle?

According to the National Association of REALTORS®, over the last five years in the Seattle Metro area, rents have increased a whopping 22.26% between whereas wages for 25-44 year olds (which comprise a good number of renters) only increased 15.3%. This time period reviewed was quarter 3 2009 to quarter 3 2014 for the rents whereas wages were reviewed 2009-2014. According to Dupre+Scott Apartment Advisors, that number is even more staggering when looking only at Seattle and since spring of 2013 – 18% higher.

This disparity along with comparisons to tech-driven job markets such as San Francisco have many wondering if Seattle could be the next city to jump on the rent control bandwagon.

According to the Puget Sound Business Journal, there was a town meeting at City Hall on April 23rd to discuss this hot topic and Mayor Ed Murray has even created a housing affordability task force to tackle the problem. The hurdle is a big one – rent control is currently illegal in Washington State.

Seattle Magazine reports that renters make up 52% of Seattle’s population, so the effects of such a law – or not passing a law – will be felt by the majority of Seattle’s residents. With the average market rent for a one bedroom, one bathroom apartment in the city of Seattle going for $1,445 per month, there are a number of renters and would-be renters who are going to have to start finding housing further away from the city center.

People for rent control point to issues like transportation that become a bigger challenge when workers cannot afford to live near where they work and have to commute in. However, those who oppose it indicate that rent control will hamper development and reinvestment in the buildings that may be in need of updating.

Whether you are a proponent of rent control or not, this debate and rent increases are driving some to turn to home ownership, even with the inventory shortages that challenging the real estate market.

However, the economics of it make sense. If you are paying $3,000 per month for a three bedroom apartment in Capitol Hill and you can buy a 3 bedroom home in Wallingford for $600,000 (even taking into account multiple offers driving up the price from $500,000 to $600,000), depending on your down payment, that mortgage and principle may only come to $2,300 per month. Add taxes and insurance on there and you might be at $2,800 per month. Remember, this is just an estimation, and prices vary, but if you are pounding your fist, hoping rent control is passed before your landlord decides to raise the rent again, you owe it to yourself to take a look at home ownership.

And remember! If you have a 30 year fixed rate mortgage, your monthly mortgage payment is your monthly mortgage payment – next year and 25 years down the road. Furthermore, you are building equity which could mean money in your pocket when you are ready to sell. Try doing that while renting!

I would be happy to give you additional information on how to make your housing dollars go further. Give me a call: (206) 226-5300 or send an email to: sold@windermere.com!

Urban Land Institute Names Seattle in Top 10 Markets to Watch in 2015

Urban Land Institute has released their “Emerging Trends in Real Estate” report for 2015 and the news for Seattle is favorable!

The Institute points to the principle of the “24-hour city” which needs to be adopted by urban areas in order to have a thriving downtown. They note that downtown transformations need to combine “housing, retail, dining and walk to work offices to regenerate urban cores” in order to increase investment for single family and multi-family housing. While most of the emerging, revitalized urban centers aren’t true 24-hour cities, they have certainly expanded from 9-5 town into “18-hour markets”. According to the report, investors are attracted to markets with “vibrant urban centers”. Some of Seattle’s most vibrant neighborhoods fit this bill.

In the report, the Urban Land Institute points to different Markets to Watch in 2015. The basis for these being markets to watch is the demand for “desired assets” which is expected to drive prices up and returns down and subsequently the need for alternative investment options which yield higher returns. One strategy noted for this in the report was the potential for investors to look at markets close to a major metropolitan area.

Seattle ranked 8th on the list overall which measures investment, development, and home building potential in 2015. Portland, Oregon ranked 16th and Tacoma ranked 62nd (this is the first year Tacoma has been measured as a separate entity outside of Seattle).

Another factor that was examined was population growth. Between 2010-2013, the urban population growth in Seattle rose 6.9% to 2.88 million people which also helped its placement in the “good market” category.

Technology is a local driver of employment in Seattle and the millennial generation is flocking in to take those jobs. It is a “top capital destination” which attracts institutional and local investors.

The report predicted that the job market in Seattle will expand 2.6% in 2014-2015.

We have a lot to be thankful for in Seattle this Thanksgiving. A robust job market, strong population growth, and of course, we live in the most beautiful place in the country! Happy Thanksgiving to you!

Seattle Real Estate Market Update October 2014

Autumn is usually a time when we see the real estate market slow down a bit. However, that has not been the case so far in many of Seattle’s neighborhoods this fall. How is your area shaping up?

Inventory of Listings

The shift in inventory as we head further into fall is very interesting! A decrease in inventory is expected as our spring and summer are our busy real estate season. However, the number of homes under contract has increased significantly in Central Seattle and Queen Anne/Magnolia along with the decrease in inventory, spelling an uptick in demand in these areas.

Demand, as measured by homes under contract, has decreased in Belltown/Downtown. Ballard/Greenlake and North Seattle are about even.

Below is a table comparing the number of active listings (supply) and pendings (demand) for several of our Seattle neighborhoods:

Median Sales Prices

Year over year median home prices have increased in most areas except Belltown/Downtown. In Queen Anne/Magnolia and North Seattle, prices have continued to increase significantly over last year. Since demand for homes in these areas have continued to be high, the prices have continued to increase.

This has been an intense year for Seattle real estate and the market continues to be brisk despite heading into our “quieter” time. I encourage you to contact me at sold@windermere.com or give me a call: (206) 226-5300 to learn more about what this market means for your real estate investment. Knowledge is power!

The Equity Formula – Why “Buying Up” Can Net You Thousands

Even though prices in the Seattle markets are continuing to climb, this can be a great time to sell your home and “buy up”. Often when a home seller “buys up” he or she purchases a home that is 1.5 times the value of the current home. So if a seller’s home has a market value of $400,000, their next home will likely be $600,000.

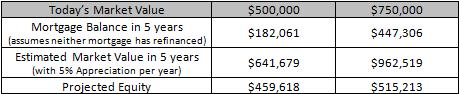

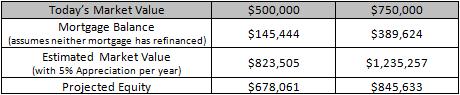

For this example, let’s assume a homeowner owns a home in Queen Anne with a market value of $500,000 purchased eight years ago for $300,000. He put 20% down and he is paying 5.75% for a 30 year fixed rate loan:

His goal is to buy a home in Ballard valued at $750,000 and he qualifies for 4.0% interest rate on a 30 year fixed rate mortgage:

![]()

The above assumes all equity from previous home sale minus 7% of sale price for home selling expenses has been put towards this purchase.

Now, let’s look five years into the future and make some assumptions regarding appreciation. Assuming the Seattle area appreciates at an average of 5% per year, let’s compare his investments if he had stayed in the same $500,000 home with the same mortgage versus if he moved up to the $750,000 home:

Wow! Both the reduction in the mortgage interest rate plus appreciation on the higher-priced home meant more equity! Now let’s project out ten years using the same variables:

Of course, these are not a guarantee that an investment will perform as illustrated here, but the value of compounding interest (both on the mortgage and on appreciation) should not be underestimated. Please give me a call at (206) 226-5300 or send an email to sold@windermere.com to learn more and strategize your next move.

Mortgage examples are for illustrative use only and are not an offer for a mortgage nor an indication that reader qualifies for such mortgage. Future market value amounts are examples of what could happen and are not a guarantee of future performance. Agent is not responsible for any financial losses that occur as a result of investments made as a result of this publication.

Multitudes of Millennials in Position to Purchase in Seattle Metro Area

According to the National Association of REALTORS® the Seattle Metro Area is one of the top ten markets in the country with the Millennial generation poised to lead the charge of first time homebuyers. Seattle, along with metros such as Austin, Dallas, Denver, Des Moines (Iowa), Grand Rapids (Michigan), New Orleans, Ogden, and Salt Lake City have strong job markets with jobs that appeal to this generation and the demand for housing hasn’t priced first time homebuyers out of the market like in New York, Los Angeles, and San Francisco.

According to NAR Chief Economist, Lawrence Yun, “NAR research finds that there are…metro areas millennials are moving to where job growth is strong and home ownership is more attainable. These markets are well-positioned to soon experience a rise in first-time buyers as the economy improves.”

The homeownership rate for young adults (under the age of 35) was 43% in 2005 (the peak) and the rate has fallen from that peak to 36% in the first quarter of 2014.

NAR measured current housing conditions, housing affordability (measured by incomes, interest rates and median home prices), job creation, and population trends across the country in metro areas that have a large millennial presence. NAR expects that as life events present themselves (marriage, kids) millennials will want to settle down and purchase a home rather than rent and live in close quarter. As long as market conditions hold and affordability is maintained, millennials are poised to be our next wave of first time homebuyers.

What does this mean for current homeowners? I expect demand will continue to be strong in our region as job growth is strong in our region. Over the next few years, if you own a home with market value under about $400,000, I expect that price point to increase in demand unless our builders complete new homes to meet that growing need. If you have questions for me or would like to learn more, please give me a call or send me an email: (206) 226-5300 or sold@windermere.com.

Build Wealth Through a Seattle Real Estate Investment

Often I am asked about the profitability of real estate investing. Real estate can be a very lucrative investment and there are a number of different avenues you can take depending on the amount you can invest, your preferred level of involvement, and your desired investment return.

Rent in the Seattle market is very high due to the demand for housing. Employment in the city limits is strong and the Seattle Times reported that average apartment rents jumped 4.1% in the second quarter of 2014 alone. Although rent rates and appreciation varies from area to area and type of rental, according to the Seattle Times, vacancy rates in King and Snohomish County are at the lowest number in nine years.

So how does this translate into a real estate investment?

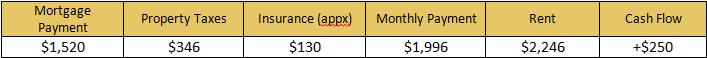

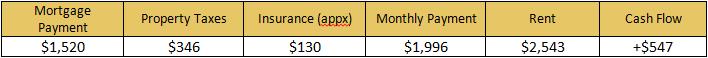

Let’s take a look at one of my current listings at 12526 8th Ave NE in Pinehurst. The list price is $375,000 and with 20% down, and assuming the rent is $1,750 per month, you can see the monthly cash flow is in the negative:

Negative cash flow? How on earth can this be a good investment? Read on!

Let’s look five years down the road. If the property has appreciated at a very modest 5% per year, the $375,000 investment which had $75,000 equity when purchased now has $207,786 in equity (due to appreciation and the investor paying the mortgage for five years).

But what about the cash flow? It is true that the investor was paying out more than $100 per month in excess of what they were bringing in, but remember, that rent was at market five years ago. Let’s also account for a 5% per year increase in property taxes and insurance, and even rent (although current demand indicates this rate could be much higher). Where does that leave our monthly cash flow?

This is only for a 5% annual increase in rent. What if it were more like 7.5%?

That cash flow is in addition to the increase in equity!

Of course, this is assuming that the owner is managing the property his or herself and it doesn’t take any repairs or modifications into account. However, each property is different and has different needs.

Intrigued? Please contact me to learn more! Email me at sold@windermere.com or give me a call: (206) 226-5300

Light Rail and It’s Impact on Seattle Real Estate

In the last few years, you may have noticed an increase in the number of listings and rentals that are touting the benefit of being in close proximity to a Sound Transit station. With demand in the city center driving real estate and rental prices up, buyers and renters are being forced to find housing further away from the city core. However, light rail is leading the charge in bringing people in from the outskirts into Seattle and people are expected to flock to areas surrounding the planned new stations in the coming years.

For example, when Sound Transit came to Tukwila a few years ago and the station near the airport opened, there was an uptick in real estate interest in the area surrounding it. Commuting via light rail from Tukwila only takes a little more than a half an hour according to the Seattle Times. In Tukwila the median sales price in April, 2014 was $205,000. In Seattle, the median sales price for the same period is $415,000*. It is much more affordable to live in outlying areas and simply commute in!

Developers, potential homeowners, and landlords are watching light rail plans very closely and are investing in areas where Light Rail will be connected. Here are just a few of the light rail projects in various planning stages which are targeted over the next several years according to www.soundtransit.org:

-

East Link Extension: There will be 10 stations along this route which will include Seattle, Mercer Island, Bellevue, Bel-Red, and Overlake in Redmond. This is expected to be completed in 2023.

-

Lynnwood Link Extension: This will link Lynnwood to Northgate. This is targeted for completion in 2023.

-

Northgate Link Extension: This will link Northgate, Roosevelt, and U District Neighborhoods to downtown Seattle and the airport. Ride time will be 14 minutes from Northgate to Downtown. It is expected to be completed in 2021.

-

University Link Extension: This will link the University of Washington and Capitol Hill to downtown Seattle and the airport. There will be two stations at UW and Capitol Hill. This project is expected to be complete in 2016.

So what does this mean for housing? Here is an example of how our market is impacted by Sound Transit’s transportation projects: University Manor Apartments near UW were recently snapped up by an investor who was very interested in the property due to its proximity to future Light Rail. The 80 unit apartment/commercial building received an amazing 14 offers. The new owner indicated that due to the amount of increased traffic in the area may call for converting the ground floor apartments back to retail. Rentals around Light Rail in the Puget Sound can command higher rent. Opportunities abound!

In addition to commuting via Light Rail for work, people are also opting to use Light Rail for traveling for recreation and events in Seattle. This helps avoid the headaches associated with battling traffic, and finding and paying for parking.

Homeowners, potential buyers, and investors should keep a close eye on opportunities surrounding planned Light Rail stations. For additional information on how our area’s transportation plans impact you, please contact me: (206) 226-5300 or sold@windermere.com.