With median sales prices continuing to rise (median sales prices for Seattle residential in February were 26.3% over February 2015 and 38.9% over February 2014). There is speculation about a bubble developing in the real estate market with over-inflated prices that are going to pop. Continue reading

Tag Archives: Seattle

Seattle Real Estate Trends: February 2016

Mariners baseball is starting in just a few weeks, the tulips are up, and all my listings are pending! Let’s see what happened in Seattle’s February real estate market in key neighborhoods:

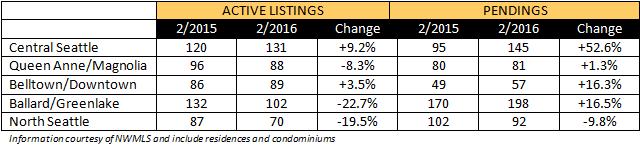

Inventory and Pendings

Below we compare the number of active listings (supply) and pendings (demand) for several of the key Seattle neighborhoods including Central Seattle, Queen Anne and Magnolia, Belltown and Downtown, Ballard and Greenlake, and North Seattle. Our table includes single family residences as well as condos comparing February 2015 and 2016.

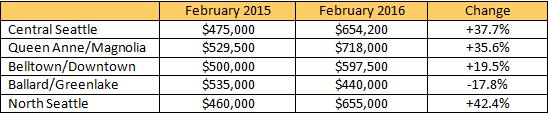

Median Sales Prices

Median sales prices are up quite dramatically in some areas comparing February 2015 versus February 2016 numbers. See the tables below!

With the number of sales dropping in some areas due to lack of inventory, median sales price adjustments may get more pronounced. For example, in North Seattle, the number of sales dropped from 81 last February to 65 this February. However, in Ballard/Greenlake, the sales went from 119 last year to 189. Belltown went from 23 last year to 40 this year. Queen Anne/Magnolia was about at par with 69 sales last year and 71 this year. Central Seattle went from 105 to 83.

In Ballard/Greenlake, there were several lower-priced properties that sold that might be skewing the median a bit. The Cove at Verdian counted for 8 of the 189 sales, all under $239,000. In addition the Vik condo project accounted for 64 sales, ranging from to $261,900 to $755,900.

Just like in Belltown last summer with the Ensignia project, as inventory is low and a buildings-worth of new product comes on the market, I expect median home prices to skew based on the pricing in the development.

The median home price for February in all of Seattle for both residential and condos was $511,000, which is 16.1% above last February’s $440,000. February had 695 listings available on the market and as of this writing, there are 747 active listings, which is good for our market.

If you would like to learn more about what is happening in your neighborhood, let’s talk! Please contact me – your Seattle Home Guy – at sold@windermere.com or give me a call: (206) 226-5300.

Seattle Real Estate Trends – January 2016

It already feels a little spring-like in Seattle. Trees are beginning to bloom, the days are getting longer, and the real estate market never even took a breath in the winter. Let’s see what happened in Seattle’s January real estate market in key neighborhoods:

Inventory and Pendings

Below we compare the number of active listings (supply) and pendings (demand) for several of the key Seattle neighborhoods including Central Seattle, Queen Anne and Magnolia, Belltown and Downtown, Ballard and Greenlake, and North Seattle. Our table includes single family residences as well as condos comparing January 2015 and 2016.

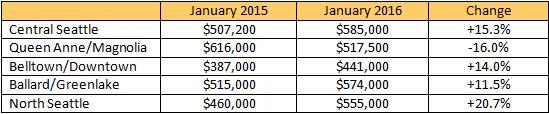

Median Sales Prices

Prices are mostly up looking at January 2015 versus January 2016 numbers. See the tables below!

The median home price for January in all of Seattle for both residential and condos was $520,000, which is 15.0% above last January’s $452,000. I was glad to see the amount of available inventory go up in January, from 548 in December to 659 this month. Last January actually had fewer listings than December, so it was good to see this shift as buyers are out in droves.

If you are thinking of a move this year, let’s talk! Please contact me – your Seattle Home Guy – at sold@windermere.com or give me a call: (206) 226-5300.

Seattle Real Estate Trends, December 2015

This 2016 is starting with the lowest number of homes for sale in Seattle in years! In December there were only 359 homes and condos for sale in all of Seattle. Let’s see what happened in Seattle’s November real estate market in key neighborhoods:

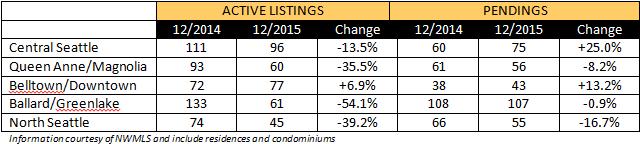

Inventory and Pendings

Below we compare the number of active listings (supply) and pendings (demand) for several of the key Seattle neighborhoods including Central Seattle, Queen Anne and Magnolia, Belltown and Downtown, Ballard and Greenlake, and North Seattle. Our table includes single family residences as well as condos comparing December 2014 and 2015.

Median Sales Prices

Prices are up both year over year and month over month. See the tables below!

I predict that 2016 will be another banner year in Seattle real estate, and I am hopeful that when interest rates start to go up our market will even back out in terms of supply and demand. Have a question about what to do about what to do with your real estate this year? Please contact me – your Seattle Home Guy – at sold@windermere.com or give me a call: (206) 226-5300.

What’s In Store for Seattle in 2016?

Each year I take a look back on the Seattle real estate market and consider what is coming up in the months to come. Here is a snapshot of my 2016 predictions for Seattle’s real estate market:

PRICES: December’s data is not yet available, but median residential home prices in Seattle have risen 13.1% over 2015. That is a significant increase! I don’t expect 2016 to have an increase quite so strong, but I do expect there to continue to be a more moderate increase since we are starting from a higher spot. Housing inventory will continue to be a challenge and a driver in our market, especially as jobs at Amazon, Google, and other tech industries continue to grow and fill the office space available. Although there are new projects and housing available, it will continue to get consumed quickly. Therefore, I predict Seattle home and condo prices to rise between 8- 10% over the next year. They rose from 2012 to 2013: 11.2% and 2013 to 2014: 7.4%.

AFFORDABILITY: I do expect this will be a very hot topic in 2016 especially in Seattle. The areas around South Lake Union, Capitol Hill, Queen Anne, and Belltown will see the highest demand. These are already areas where rent – and prices – are soaring, and the people who are moving in for work may be priced out. First time homebuyers will be priced out of many of these areas (as well as renters if rent increases faster than wages). Therefore, they may be looking in neighborhoods just outside of there (such as Ballard, Greenlake, Leschi, etc) and look to mass transit.

INVENTORY: There were 1,133 homes and condos available for sale last November. This year there were only 739 – a 34.8% decline. The average days on market for a home or condo sold October-December of 2014 was 34. That has declined to 22 in October-December of 2015. There are a number of condo developments on the horizon for 2016, but we need more to house the number of people coming into the area.

According to Seattle.gov, 2010’s population estimate was 608,660 and the population estimate for 2015 is 662,400. This means that within the last five years, we needed to house 53,740 additional people. That is 10,748 per year or 207 people per week. No wonder we have an inventory challenge! The job market is going to continue to be strong in 2016 and more workers will be on the hunt for housing!

ADUs and DADUs: Accessory Dwelling Units (ADUs) and Tiny Accessory Dwelling Units (DADUs) are separate living spaces within a house or on the same property as an existing house which are legally permitted. Mayor Murray put forth his aggressive Housing Affordability and Livability (HALA) plan this past year to create 50,000 housing units over the next ten years. Increasing the number of ADUs and DADUs are on the HALA report for 2016 and I predict that we will see many ADU and DADU units built on lots to increase urban density. These are also referred to as cottage housing, small duplexes, and backyard cottages. There may be an opportunity for you to build an ADU or DADU in your own backyard! You can find out more information on ADUs and DADUs and the HALA report here:

- http://www.seattle.gov/dpd/permits/commonprojects/motherinlawunits/default.htm

- https://www.municode.com/library/wa/seattle/codes/municipal_code?nodeId=TIT23LAUSCO_SUBTITLE_IIILAUSRE_DIV2AUUSDEST_CH23.44RESIMI_SUBCHAPTER_IPRUSPEOU_23.44.016PAGA

- http://murray.seattle.gov/wp-content/uploads/2015/09/MayorsActionPlan_Edited_Sept2015.pdf

INTEREST RATES: The Federal Reserve decided to raise the short term interest rates at their December meeting, which will undoubtedly cause mortgage interest rates to rise over the coming year, perhaps as much as to 5.5%. Although this will affect how much home a buyer can afford, I don’t expect it will diminish demand significantly.

If you would like to learn more about what is in store for 2016 and how what is happening with the real estate market affects your real estate investment, please give me a call or text: (206) 226-5300 or email: sold@windermere.com.

Seattle Real Estate Trends, Nov 2015

Usually things quiet down a bit this time of year, especially between Thanksgiving and Christmas. Not so in 2015! Buyers who were frustrated this summer due to not winning with multiple offers are back, hoping to buy while there is a slight lull and before interest rates go up. However, we aren’t seeing the bump in available inventory this late fall. In fact, in November, we dropped to the lowest number of homes and condos available for sale in the last ten years at 740 units. The number of homes under contract for November was 821 which means that properties are still flying off the market very quickly and the demand cannot be satiated!

Let’s see what happened to Seattle’s real estate market in key neighborhoods this November:

Inventory and Pendings

Below we compare the number of active listings (supply) and pendings (demand) for several of the key Seattle neighborhoods including Central Seattle, Queen Anne and Magnolia, Belltown and Downtown, Ballard and Greenlake, and North Seattle. Our table includes single family residences as well as condos comparing September 2014 and 2015.

Median Sales Prices

Prices are still on the rise. November’s median home price for residential and condos was $513,600 – a 17% increase over last November. 17%! In fact, the only month ever with a higher median sold price was this last August at $536,000.

I do expect the Federal Reserve will be raising rates in December, and although that might give buyers some breathing room due to less competition, there is still a lot of pent up demand (and still-growing demand due to our local economy) to be satisfied before we can resume a more-normal market.

My predictions will be out soon for 2016 and if you would like to receive those by mail, please contact me – your Seattle Home Guy – at sold@windermere.com or give me a call: (206) 226-5300.

Home Heating Systems in Seattle: What Home Buyers Need to Know

Brrrr!! It is a cold one out there. This morning I am thankful for an advanced heating system that keeps me toasty. Do you know about all the different types of heating systems we have in Seattle? As a home buyer, it is important to learn more about your system and have a good understanding of how it works, what maintenance is involved, and what to watch out for to keep your system in top shape. According to Seattle City Light, “space heating represents the single largest energy consumer in the typical Seattle home.” This can get expensive! Below is a summary of what we might see out on the market:

Furnaces – Furnaces with forced air are the most common type of heat system used in our area. These utilize natural gas or electricity (most commonly) but some systems still utilize oil.

Heat Pumps – Although heat pumps are run on electricity, according to Seattle City Light they can be 200% efficient because they draw heat from the air outside. Unless the temperature gets down very low (in the 30’s or below generally speaking), the heat pump can still draw heat out of the air and move it into the house.

Boilers – Boilers heat water and pump it through the house through pipes – some of which may be located underneath the floor while others have baseboard pipe systems (which look like baseboard heaters, but actually are radiators). Boilers can utilize natural gas, oil, and electricity.

The above systems are usually designed to heat entire homes. There are also systems that heat room by room such as:

- Electric baseboard heaters: These produce a good amount of heat, but distributing it through the room can be tough. Furniture placement can also be a challenge.

- Electric recessed wall heaters: These, like baseboard heating, can produce a good amount of heat with distribution challenges. However, some contain a blower which helps.

- Electric radiant heat: There are whole-home systems and systems that can be installed in individual rooms such as under tile (where heat is then stored).

- Fireplaces (gas, electric, or even wood-burning): These not only provide nice ambiance, but they are a great option to heat individual rooms. Unfortunately, they are not a very efficient option due to the heat loss up the chimney.

- Pellet or wood burning stoves: Pellet stoves work similarly to fireplaces in that they primarily heat the room they are in. However, blowers can help distribute the heat into different rooms in the house.

- Ductless heat pumps: These are beginning to climb in popularity because they are even more efficient than a ducted heat pump (as there is heat loss within the duct system) and they only heat the room you need to have heated (or have different rooms heated to different temperatures). Furthermore, in the summer, they can cool!

When buying a home, I recommend having the heating system inspected and learning what you need to do in terms of maintenance. This might include duct cleaning, filter replacement, or an annual tune up including topping off fluids. Some older systems may be so inefficient that replacement actually makes better financial and environmental sense. In some cases, rebates from the Department of Energy, Cascade Natural Gas, Puget Sound Energy, or Seattle City Light (or another local gas or electricity provider) may be available. And a new system will improve your home value!

Don’t be left in the cold this winter. I can put you in touch with someone who can help you determine how to keep your system in tip-top shape and add dollars to your bottom line. Give me a call at (206) 226-5300 or send an email to sold@windermere.com.

Seattle Real Estate Market Update, October 2015

Inventory of Seattle of homes for sale is still at a ten year low for October at 1,018 homes and condos available for sale. The ten year average up to 2014 is 2,879 homes which puts us 64.6% below that average. Our pending listings were at 985 for October, which is above our 802 average (22.8% above average).

Let’s see what happened in the October Seattle real estate market in key neighborhoods:

Inventory and Pendings

Below we compare the number of active listings (supply) and pendings (demand) for several of the key Seattle neighborhoods including Central Seattle, Queen Anne and Magnolia, Belltown and Downtown, Ballard and Greenlake, and North Seattle. Our table includes single family residences as well as condos comparing September 2014 and 2015.

Median Sales Prices

Seattle residential and condo median home prices continued to see median sales price increase of 8.9% over last October to a price of $485,000.

The average days on market for sold residential and condos in October was 18 days. This includes properties up to $5,750,000 (the highest price sale in October). This is one day less than September’s sales. Last October, the average days on market in Seattle was 32, so we have had a 43.8% decline in days on market over the last year. That is remarkable!

While the Seattle real estate market appears to be undefeated, I wish I could say the same for the Seahawks. However, like the real estate market, I expect great things in the coming weeks! We are only half way through the season and eight games to go and you can bet I show up in my team blue each Friday and I hope you do too. Go Hawks!

Please contact me – your Seattle Home Guy – at sold@windermere.com or give me a call: (206) 226-5300 to discuss what this market means for you.

Seattle’s Cranes: An Indicator of Future Growth

Do you know how many construction cranes are towering over Seattle building our future offices, condos, and retail centers? 20? 25? Believe it or not, according to the Rider Levett Bucknall Crane Index, which produces the North American RLB Crane Index, there are 42 cranes hard at work, altering Seattle’s skylines.

The Crane Index is published twice a year. It tracks the number of fixed cranes in major cities across North America and is an indicator of the construction workload in an area. Residential projects currently make up less than half of the craned projects in the Seattle area (Lake Washington to West Seattle and Northgate to Boeing Field). The index does not include Bellevue and Everett. According to the Puget Sound Business Journal, the Boeing 777X facility has 17 cranes on site alone.

It is no secret that this has been the busiest construction period that Downtown Seattle has seen in over a decade. While the RLB Crane Index indicated that the number of cranes decreased in Seattle since their last report at the beginning of the year (by nine), the number is expected to increase again according to the Puget Sound Business Journal. A number of projects have recently broken ground or are in the permitting phase.

What does this mean for the Seattle real estate market?

- An increase in office space and retail space means more employees who will need housing.

- An increase in residential units including apartments and condos will fulfill some of that need.

- An increase in transportation facilities will help people move throughout the region faster, making housing in the outlying areas more attractive.

- Some projects are for medical, hotels, and other infrastructure (such as the Elliott Bay Seawall) which will support Puget Sound residents.

I am excited for what Seattle’s economic future has in store! I predict demand will continue to be high in the coming years. What does this mean for you? Give me a call: (206) 226-5300 or send me an email: sold@windermere.com.

President Xi Jinping’s Visit to Seattle Could Prove Lucrative for the Puget Sound

The Chinese president, Xi Jinping, made an historic, first state visit to the United States this past week, visiting the Seattle area along the way.

The president’s agenda for the rest of his U.S. jaunt include a working dinner at the White House with President Obama, state dinner at the White House, and then proceed to New York where he will participate in meetings at the United Nations.

To have the highest-ranking state official from the world’s most populous nation with the second highest GDP in the world ($11.2 trillion per year according to CNN. The US is first with $18.1 trillion) choose to visit our area on his first state visit is huge!

Below are some of the highlights from his trip to the Puget Sound:

- He visited Everett Boeing plant where he got a peek at a 787 jet that was under construction, contracted by Xiamen Air, China’s first privately owned airline. Xi indicated that China will continue to need aircraft produced by Boeing over the next 30 years – with a price tag of $950 billion (about 6,330 new planes). A $38 billion, 300 jet contract between the Chinese and the plane maker was announced.

- He participated in a roundtable meeting organized by The Paulson Institute (hosted by former U.S. Treasury Secretary, Hank Paulson) and a Chinese trade organization, in which CEOs of some thirty U.S. and Chinese companies came together to discuss overcoming challenges with gaining greater access to each other’s markets. This open dialogue is critical for both countries to utilize each other’s resources and markets.

- He visited Lincoln High School in Tacoma. This is actually not his first visit to Tacoma. Twenty two years ago, he worked on developing a sister city relationship with Tacoma and Fuzhou, China (where he was a leader).

- He visited Microsoft in Redmond where he attended the U.S. China Internet Industry Forum which was hosted by Microsoft and the Internet Society of China. He met with tech executives Jeff Bezos of Amazon, Mark Zuckerberg of Facebook, executives from Alibaba (an Amazon-like company in China), representatives from Cisco, Apple, IBM, Intel, LinkedIn, and Airbnb as they toured the Microsoft campus and watched demonstrations of high-tech products. According to the Seattle Times, the attendees are “betting that their future relies on China.”

Between aerospace, technology, and potential trade growth for the new Northwest Seaport Alliance between the Ports of Tacoma and Seattle, the Northwest, and especially the Puget Sound area, is poised to take full advantage of the opportunities for an expanded economy in China. The president didn’t go to Los Angeles. He didn’t go to San Francisco. Economically, I am very excited about how this has the potential to strengthen Seattle’s economy even further.