It can be tough to get around in Seattle and on the Eastside. As we add hundreds of people per week to our expanding city, and even more to the whole area, the problem is not going to go away anytime soon. More-flexible work schedules and people working from home will certainly help, but in the coming years, as Link light rail expands, the value of properties around those light rail stops were expected to go up. But now there is a study that substantiates that!

Category Archives: Real Estate Investing

The Future of Puget Sound Area Traffic

Sound Transit has put forth an ambitious plan, called the Sound Transit 3 Plan, to extend Light Rail service throughout the Puget Sound area. The plan is currently receiving public feedback from a number of neighborhood meetings being held throughout the different neighborhoods that will be affected. The finalized plan may be on the ballot in November. All residents (not just homeowners – renters too!) need to be aware of the expansion plan, the timeline, and the bottom line. I encourage you to go to one of the live meetings if you are able to do so. Continue reading

Seattle Real Estate Trends: March 2016

I am glad to see the number of homes on the market picking up as there are a lot of buyers out there who need to buy homes! I have ten listings and six of them pended in about seven days. The others haven’t been on the market yet a week but I expect them to go fast.

Let’s see what happened in Seattle’s March real estate market in key neighborhoods: Continue reading

No Bubble for Seattle Real Estate Market

With median sales prices continuing to rise (median sales prices for Seattle residential in February were 26.3% over February 2015 and 38.9% over February 2014). There is speculation about a bubble developing in the real estate market with over-inflated prices that are going to pop. Continue reading

What’s In Store for Seattle in 2016?

Each year I take a look back on the Seattle real estate market and consider what is coming up in the months to come. Here is a snapshot of my 2016 predictions for Seattle’s real estate market:

PRICES: December’s data is not yet available, but median residential home prices in Seattle have risen 13.1% over 2015. That is a significant increase! I don’t expect 2016 to have an increase quite so strong, but I do expect there to continue to be a more moderate increase since we are starting from a higher spot. Housing inventory will continue to be a challenge and a driver in our market, especially as jobs at Amazon, Google, and other tech industries continue to grow and fill the office space available. Although there are new projects and housing available, it will continue to get consumed quickly. Therefore, I predict Seattle home and condo prices to rise between 8- 10% over the next year. They rose from 2012 to 2013: 11.2% and 2013 to 2014: 7.4%.

AFFORDABILITY: I do expect this will be a very hot topic in 2016 especially in Seattle. The areas around South Lake Union, Capitol Hill, Queen Anne, and Belltown will see the highest demand. These are already areas where rent – and prices – are soaring, and the people who are moving in for work may be priced out. First time homebuyers will be priced out of many of these areas (as well as renters if rent increases faster than wages). Therefore, they may be looking in neighborhoods just outside of there (such as Ballard, Greenlake, Leschi, etc) and look to mass transit.

INVENTORY: There were 1,133 homes and condos available for sale last November. This year there were only 739 – a 34.8% decline. The average days on market for a home or condo sold October-December of 2014 was 34. That has declined to 22 in October-December of 2015. There are a number of condo developments on the horizon for 2016, but we need more to house the number of people coming into the area.

According to Seattle.gov, 2010’s population estimate was 608,660 and the population estimate for 2015 is 662,400. This means that within the last five years, we needed to house 53,740 additional people. That is 10,748 per year or 207 people per week. No wonder we have an inventory challenge! The job market is going to continue to be strong in 2016 and more workers will be on the hunt for housing!

ADUs and DADUs: Accessory Dwelling Units (ADUs) and Tiny Accessory Dwelling Units (DADUs) are separate living spaces within a house or on the same property as an existing house which are legally permitted. Mayor Murray put forth his aggressive Housing Affordability and Livability (HALA) plan this past year to create 50,000 housing units over the next ten years. Increasing the number of ADUs and DADUs are on the HALA report for 2016 and I predict that we will see many ADU and DADU units built on lots to increase urban density. These are also referred to as cottage housing, small duplexes, and backyard cottages. There may be an opportunity for you to build an ADU or DADU in your own backyard! You can find out more information on ADUs and DADUs and the HALA report here:

- http://www.seattle.gov/dpd/permits/commonprojects/motherinlawunits/default.htm

- https://www.municode.com/library/wa/seattle/codes/municipal_code?nodeId=TIT23LAUSCO_SUBTITLE_IIILAUSRE_DIV2AUUSDEST_CH23.44RESIMI_SUBCHAPTER_IPRUSPEOU_23.44.016PAGA

- http://murray.seattle.gov/wp-content/uploads/2015/09/MayorsActionPlan_Edited_Sept2015.pdf

INTEREST RATES: The Federal Reserve decided to raise the short term interest rates at their December meeting, which will undoubtedly cause mortgage interest rates to rise over the coming year, perhaps as much as to 5.5%. Although this will affect how much home a buyer can afford, I don’t expect it will diminish demand significantly.

If you would like to learn more about what is in store for 2016 and how what is happening with the real estate market affects your real estate investment, please give me a call or text: (206) 226-5300 or email: sold@windermere.com.

Amazon Set to Lease More Office Space in Downtown Seattle

According to the Seattle Times, Amazon has leased a full city block in South Lake Union which was originally occupied by Troy Block. This is a two building development with 817,000 total square footage leased. The first of these two buildings will be open in 2016 and the other in 2017. The total square footage occupied by Amazon could accommodate 50,000 employees which would make Amazon the largest employer in Seattle.

While there are some concerns about Amazon occupying 25% of Seattle’s available inventory of premium office space, I would like to focus on what this could mean for our local real estate market.

As you probably are aware, we have a shortage of available homes in our Seattle real estate market. There is a shortage of condos, residences, and rentals causing rental rates to increase excessively. There are some apartment buildings in the area that are renting apartments in excess of $4,000 per month for a two bedroom apartment just over 1,000 square feet. The City of Seattle and King County have turned density and growth into hot, highly debatable, topics. Unless we allow for areas of higher density, house prices are going to continue to rise, causing would-be workers to be priced out of the urban core due to high rents or housing prices.

The second hot topic is transportation. Sound Transit and Light Rail are going to be a part of our long-term solution for dealing with the increase in traffic that more jobs in the Downtown core creates. Although I mentioned Amazon earlier, Facebook is also expanding Downtown according to Geekwire, along with Zillow, Twitter, Tableau, and Google which means more employees at these companies as well.

What do homeowners and would-be homeowners need to know? If you are renting, please talk to a real estate agent about what the next five years could look like for you in terms of rent versus your purchasing a home or a condo. There may be loan programs available that will allow you to purchase property with a lower down payment than you expected.

I will be keeping an eye on what Seattle and King County are doing to handle the density problem which could affect homeowners in our area. In other cities where additional dwellings are allowed on a city lot, the value of those lots have gone up significantly. I will be sure to keep you in the loop if something like that comes to the Seattle real estate market! In the meantime, please contact me with any questions you have about our local housing market: (206) 226-5300 or email sold@windermere.com.

Seattle Real Estate Trends, January 2015

Although the groundhog predicted six more weeks of winter, the Seattle real estate market is hopping like it is spring. Check out the market trends below.

Inventory of Listings

We are starting the year once again with a shortage of inventory in many of our Seattle neighborhoods. Since there are buyers in the market right at this moment, I see this as a window of opportunity for sellers before spring to sell before additional competition comes on the market and interest rates begin to creep up which will limit some buyers. Of course, whether the time is right for you to make a move will depend on a variety of factors including where you want to move to. If you are considering a move, please schedule a meeting with me as soon as possible to explore your options.

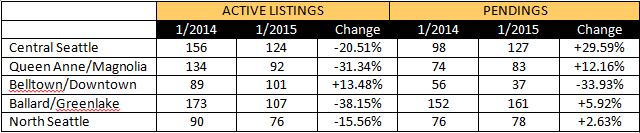

Below is a table comparing the number of active listings (supply) and pendings (demand) for several of our Seattle neighborhoods (these numbers include single family residences as well as condos). We are looking at January 2014 versus January 2015:

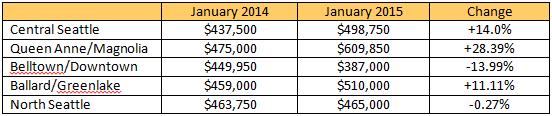

Median Sales Prices

As a result of this low inventory, prices are up year over year in most neighborhoods. Check out Queen Anne / Magnolia with a 28% increase! However, with the inventory numbers above, there is bound to be increased demand. The opposite is currently true in Belltown / Downtown. The number of active listings has increased, and pendings have decreased. Prices seem to be adjusting accordingly, but it will be interesting to note if this is an ongoing trend.

Want to learn more about what our 2015 market means for your real estate investment goals? Contact me at sold@windermere.com or give me a call: (206) 226-5300.

Seattle Real Estate Market Update – November 2014

The holidays are upon us and with the wintery weather we saw last month, it looks like several areas are seeing a temporary cooling off while people are focused on their holiday activities. This can spell a great opportunity for both buyers and sellers because the most serious of these are still in the market!

Buyers, if you have been waiting, trying to avoid competing, now might be your moment. Sellers, there ARE serious buyers out there which could spell opportunity. What should you keep your eyes open for this holiday season?

Inventory of Listings

Although the number of listings and the number of pendings has declined moving from October into November (which is normal for this time of year), it is interesting to note that the number of homes on the market has decreased looking at year over year number of listings. Comparing November 2014 and November 2013, the number of available listings has deceased in all five of the neighborhoods I track:

- Central Seattle -22.9%

- Queen Anne -8.8%

- Belltown -8.3%

- Ballard -6.5%

- North Seattle -8.5%

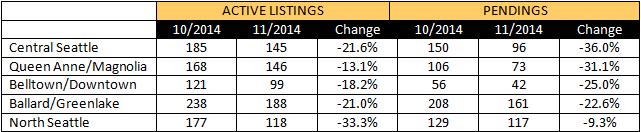

Below is a table comparing the number of active listings (supply) and pendings (demand) for several of our Seattle neighborhoods (these numbers include single family residences as well as condos):

Median Sales Prices

Median sales prices have taken a slight step back in Central Seattle, Queen Anne/Magnolia, and Belltown looking at the year over year comparison between November of 2014 and 2013. If you look at the table above, specifically the ratio of active listings to pending listings, note that in the areas where the number of pendings is close to the number of active listings (such as North Seattle where the number of active listings is 118 whereas the number of pendings is 117) we aren’t seeing the price declines that some of the other areas see.

Please take time during this month to contact me at sold@windermere.com or give me a call: (206) 226-5300 to learn more and to receive my 2015 predictions for the real estate market!

Urban Land Institute Names Seattle in Top 10 Markets to Watch in 2015

Urban Land Institute has released their “Emerging Trends in Real Estate” report for 2015 and the news for Seattle is favorable!

The Institute points to the principle of the “24-hour city” which needs to be adopted by urban areas in order to have a thriving downtown. They note that downtown transformations need to combine “housing, retail, dining and walk to work offices to regenerate urban cores” in order to increase investment for single family and multi-family housing. While most of the emerging, revitalized urban centers aren’t true 24-hour cities, they have certainly expanded from 9-5 town into “18-hour markets”. According to the report, investors are attracted to markets with “vibrant urban centers”. Some of Seattle’s most vibrant neighborhoods fit this bill.

In the report, the Urban Land Institute points to different Markets to Watch in 2015. The basis for these being markets to watch is the demand for “desired assets” which is expected to drive prices up and returns down and subsequently the need for alternative investment options which yield higher returns. One strategy noted for this in the report was the potential for investors to look at markets close to a major metropolitan area.

Seattle ranked 8th on the list overall which measures investment, development, and home building potential in 2015. Portland, Oregon ranked 16th and Tacoma ranked 62nd (this is the first year Tacoma has been measured as a separate entity outside of Seattle).

Another factor that was examined was population growth. Between 2010-2013, the urban population growth in Seattle rose 6.9% to 2.88 million people which also helped its placement in the “good market” category.

Technology is a local driver of employment in Seattle and the millennial generation is flocking in to take those jobs. It is a “top capital destination” which attracts institutional and local investors.

The report predicted that the job market in Seattle will expand 2.6% in 2014-2015.

We have a lot to be thankful for in Seattle this Thanksgiving. A robust job market, strong population growth, and of course, we live in the most beautiful place in the country! Happy Thanksgiving to you!

Seattle Real Estate Market Update October 2014

Autumn is usually a time when we see the real estate market slow down a bit. However, that has not been the case so far in many of Seattle’s neighborhoods this fall. How is your area shaping up?

Inventory of Listings

The shift in inventory as we head further into fall is very interesting! A decrease in inventory is expected as our spring and summer are our busy real estate season. However, the number of homes under contract has increased significantly in Central Seattle and Queen Anne/Magnolia along with the decrease in inventory, spelling an uptick in demand in these areas.

Demand, as measured by homes under contract, has decreased in Belltown/Downtown. Ballard/Greenlake and North Seattle are about even.

Below is a table comparing the number of active listings (supply) and pendings (demand) for several of our Seattle neighborhoods:

Median Sales Prices

Year over year median home prices have increased in most areas except Belltown/Downtown. In Queen Anne/Magnolia and North Seattle, prices have continued to increase significantly over last year. Since demand for homes in these areas have continued to be high, the prices have continued to increase.

This has been an intense year for Seattle real estate and the market continues to be brisk despite heading into our “quieter” time. I encourage you to contact me at sold@windermere.com or give me a call: (206) 226-5300 to learn more about what this market means for your real estate investment. Knowledge is power!